Margin requirement is one of the most misunderstood concepts in leverage trading but at the same time, it is one of the most important factors to manage effectively.

Managing your capital requirements is a key ingredient to effectively finding the right balance between risk and reward.

The amount of margin depends on the broker and the amount of leverage you choose to trade with.

For traders who are into crypto margin trading, this guide will be a good addition to your knowledge base since the core concept of crypto margin is based on how you use your collateral.

I will go in-depth explaining what margin requirement is and how it works. I will also discuss how you can use it to better use your margin in different markets such as forex, crypto, and stocks when trading with leverage.

Key takeaways

- Margin requirement is the amount of collateral money that you add from your own balance when opening a leveraged position in forex, crypto, stocks, spread betting, or any other leveraged product.

- Your capital requirement works the same way as a downpayment on a mortgage where you are obligated to add a certain amount of the total loan value in order to receive the full loan. In this case, you need to add a certain amount of the total trade value to open the position.

- Initial margin is the amount a trader is required to deposit to open a trade and maintenance margin is the amount required balance to maintain in the account to keep all positions open.

- Margin requirement is calculated by taking the total position size and subtracting the leverage.

Content table

- Margin requirement explained

- How margin requirement works

- Initial and maintenance margin

- Margin requirement examples

- Calculation of margin requirement + formula

- Importance of margin requirement in risk management

- Margin requirement and leverage

- Difference between margin requirement and margin levels

- Margin call

- Margin requirements in different markets

- Regulatory framework

- Advantages and risks

- FAQ

- Conclusion

What does margin requirement mean?

Margin requirement is the amount of money that a trader needs to deposit as collateral in order to open a position with leverage.

This collateral money acts as risk capital and will cover the potential losses that might incur when trading.

In essence, it is the minimum amount of money that a trader needs to have in his trading account to be able to open and maintain positions open.

When trading with leverage, the requirement is usually only a fraction of the total trade value. For example, when trading 1:100 leverage, the requirement is only 1%.

Some brokers have a minimum requirement amount of around 25% to 50% of the total account equity, however, there are leverage trading platforms that ask for much lower requirement when trading with high leverage.

How margin requirement works

Margin requirement works by requiring traders to make an initial investment in their trading account in order to both open positions and keep them open.

After the initial deposit has been made, the trader can then use this money to trade different markets at different leverage ratios.

Depending on how much margin has been deposited the position value will increase or decrease.

For example, if you deposit $100 as the requirement and open a position with 1:10 leverage, your position size will be $1000.

Should you make an initial deposit of $500 and trade 1:10 leverage, your position size is $5000.

It is also the deposited capital that absorbs all of the potential leveraged losses that incur.

Should your balance level fall below the required level, your broker might ask you to close out some positions or deposit more capital.

In this way, margin requirements help make sure that the trader has enough money to cover losses and reduce the risk of liquidation.

Initial Margin and Maintenance Margin

The two types of margin requirements are initial and maintenance.

The initial is the required funds that you must deposit to open a position and the maintenance capital is the required funds you need to have in your trading account to keep positions open.

If you don’t have enough funds to deposit as the initial capital, you will not be able to open positions.

If your maintenance level falls below the required level, your leverage broker might send you a margin call, asking you to either close one of your positions or add more funds.

The reason for these requirements is the same, to ensure that traders have enough funds to cover potential losses.

Margin requirement example

One way to illustrate how margin requirement works in a real scenario is to look at this example.

Let’s say you were to deposit $1000 into your trading account and you want to trade crypto with 100x leverage on a crypto leverage trading platform.

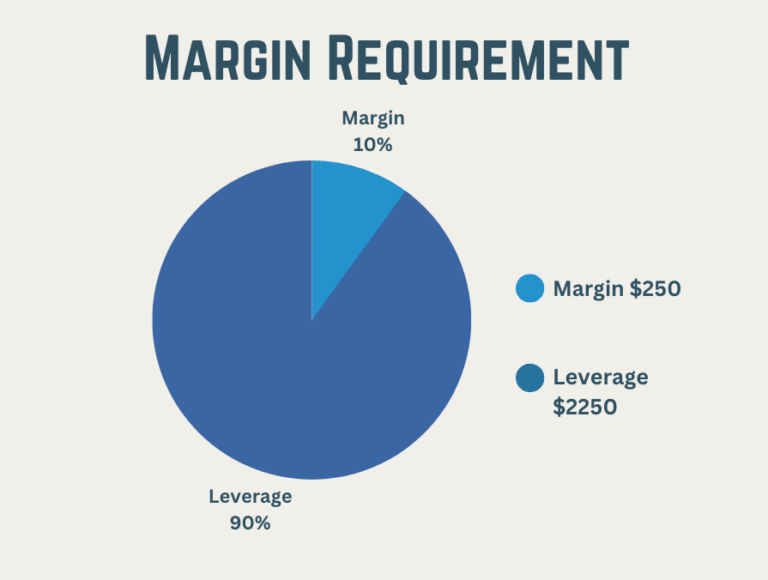

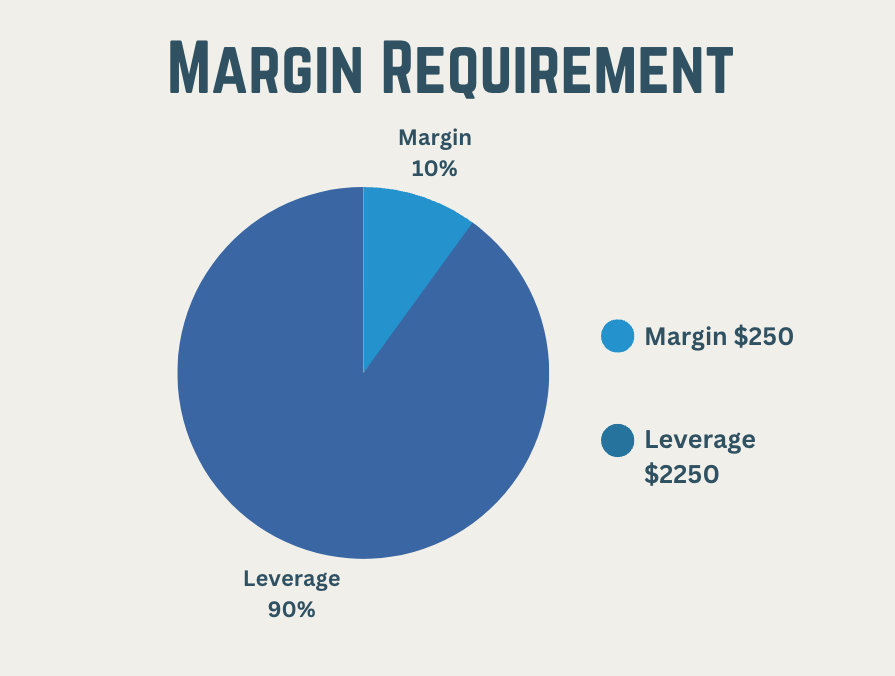

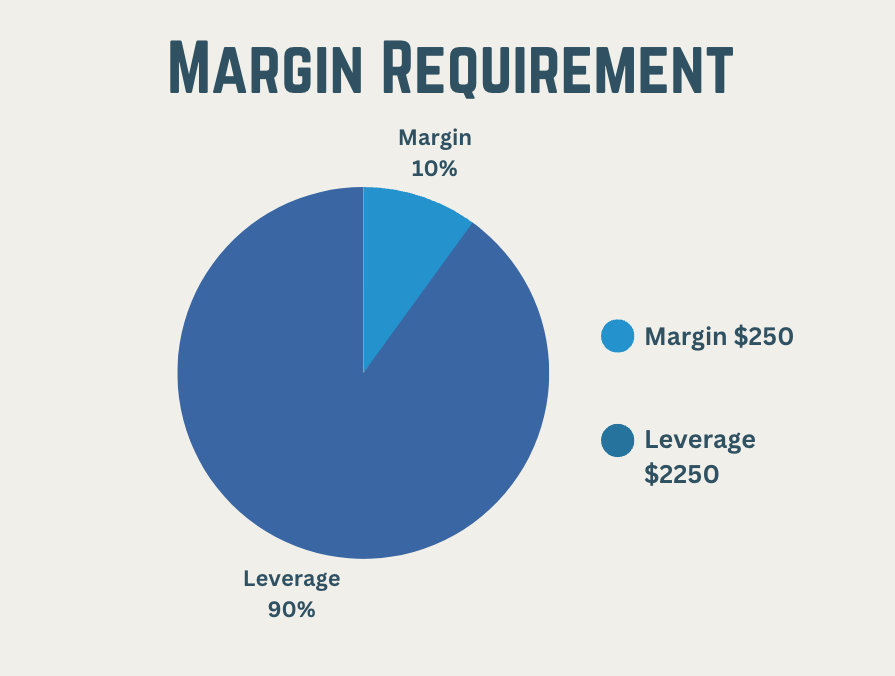

You are going to take a position in Bitcoin with 1:20 leverage.

At a 1:20 leverage ratio, your requirement is 5% of the total position size.

If you use the total $1000 as balance, you could open a position size of of $20,000.

Should you want to trade only $5000 worth of Bitcoin with the same leverage ratio, your requirement is still only 5% which is equal to $250.

Should your position go against you and turn into a loss, the required margin level will fall as well.

This can cause your leverage crypto exchange to ask you to deposit more money to maintain a healthy level of money.

Calculation and formula

The margin requirement calculation may vary depending on the asset and the broker you are using but there are some general formulas that you can follow.

The formula for calculating the initial requirement is:

Initial = (Position Size x Market Price) / Leverage

The formula for calculating the maintenance balance is:

Maintenance = (Position Size x Market Price x Maintenance Margin Requirement) / Leverage

These formulas can help you estimate the amount of collateral money you need to deposit into your account to get started and the amount your need to keep in your account to maintain positions open.

Importance of margin requirement in risk management

Margin requirement is crucial when it comes to risk management as it helps traders to manage the total exposure in any market and this in turn helps prevent unwanted losses.

It is a great way to ensure that traders have enough capital to cover potential losses and once you know how to change between leverage ratios your strategy becomes much more efficient.

Also, as leverage increases the potential for loss, it is the required balance that keeps traders from overleveraging.

Without this system in place, traders could open huge position sizes without having anything to fall back on and all the risk would be taken by the broker.

Since brokers make money from leverage it is their job to limit the amount of leverage used and balance it out with proper risk capital.

Margin requirement and leverage

Margin goes hand in hand with leverage as they are closely related when it comes to trading.

Leverage is the amount of money you borrow from your broker and the requirement is the other half of the trade that comes from your wallet.

Depending on how much leverage you use, the capital will change.

At a 1:5 leverage ratio, you are required to deposit 20% of the total trade value yourself.

This means that if you were to trade a position size of $1000 with a leverage ratio of 1:5, your capital would be $200.

As you increase or decrease the amount of leverage you use, the amount of margin needed to open trade will also change accordingly.

A higher leverage ratio means a lower required capital.

The difference between lot size vs leverage is that position size dictates the number of units, for example, 1000, 10,000, or 100,000 units in forex. Leverage on the other hand is the multiplier of your funds.

Difference between margin requirement and levels

These two concepts are also related in trading and but they serve two different purposes.

The difference is that the balance requirement refers to the minimum amount of money that you need to deposit to open positions and keep them open.

Money levels on the other hand are the percentage of the capital in a trader’s account relative to their open positions.

Should your margin levels fall below the minimum threshold you will surely get notified by your broker.

This notification is a warning telling you that you have taken on too much risk and you either need to deposit more capital or reduce your exposure to return to normal levels.

Margin call

A margin call is a warning signal from your broker to alert you that your levels have fallen below the safety threshold.

This means that your account has taken on losses and you are running low on funds.

Should you run out of funds, your account will suffer a full liquidation which means that all your funds have been lost.

There are three ways to deal with a margin call:

- Deposit more margin capital

- Close one or several positions

- Avoid it

The most common solution to this problem is to add more capital or to close out some positions.

The use of a margin call calculator can help you avoid warning calls by calculating at what price your warning will occur.

If you use good leverage trading strategies and include a stop loss when trading you are less likely to find yourself in this situation.

Our stop loss calculator can help you improve your risk management and the use of your balance requirement.

Margin requirement in different markets

Margin requirements can be different depending on the type of asset and market you trade. Forex, stocks, futures, options, spread betting, and crypto all have different frameworks.

It usually boils down to how much leverage is offered by the broker.

In forex and crypto, for example, higher leverage ratios are offered and this means that a much lower required balance is put in place.

This means that traders can access more money with less capital.

In stock trading with leverage, the ratios tend to be much lower and therefore traders are asked to deposit more money as risk capital.

Spread betting leverage is also combined with higher leverage ratios meaning that traders only need to put down a fraction of the total trade size as requirement.

Margin requirement and regulatory framework: SEC, FINRA, CFTC

Different regulations to control margin requirements have been put in place by various government agencies such as the Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA), the Financial Conduct Authority (FCA), and the Commodity Futures Trading Commission (CFTC).

These agencies control leveraged brokers by setting rules and guidelines.

Traders should be informed of the different regulations that their broker is complying with to maximize security when trading.

This helps them avoid potential legal and financial consequences.

Advantages and risks

There are definitely more advantages than risks with having a system in place that controls the amount of money traders have to put down to open large positions.

Without such a system, traders would be left to their own devices, and looking back at history this has never proven to be a wise option.

Margin requirements let traders trade leveraged markets within certain risk limits while at the same time being able to size up heavily.

This is the perfect balance between using extra buying power while staying at a safe distance from excess risk.

FAQ

This means that you need to add 25% of your capital as margin.

This means that you are trading only with your capital where 100% of the position size is your own money.

This means that you need to add 30% of the position value from your trading capital.

A level of around 50% to 5% is considered a safe level for beginners. A 5% margin means a leverage ratio of 1:20.

Conclusion

Margin requirement is an underestimated concept in leveraged trading and without this system, many traders would go bankrupt quickly.

By understanding how it works and how to calculate it, you can use it to your advantage by selecting the perfect position size according to your risk profile.

Knowing your required balance and using our risk reward ratio calculator lets you take full control over your risk.

Thanks to this system and these guidelines put in place by regulated brokers, traders can trade their favorite markets with extra buying power safely.

Whether you are trading forex, stocks, crypto, or spread betting, understanding and managing your margin requirement is a key component for success.