In this guide, we’ve ranked the best crypto leverage platforms offering high leverage for traders in over 150 countries, including the USA, the UK, Canada, Australia, and Europe.

If you want to boost your position size through a leverage-traded contract to increase profits through trading, you’ve landed on the right page.

This type of investing offers some of the most skewed risk-reward situations for day traders with the opportunity to amplify returns, and of course, increased risk.

In this guide, our expert will share our top picks and provide all the information you need to make the best decision possible.

Key takeaways

- BYDFi is a standout option, offering advanced trading tools, high leverage of up to 200x, low fees, and compliance with U.S. regulations.

- BTCC offers the highest leverage at 500x for major pairs, including risk-free demo trading and automatic margin adjustment for added risk management.

- Phemex is the best choice for mobile trading with its user-friendly app, 100x leverage, and fast fiat deposit options.

- This guide highlights the leading platforms for leverage trading in 2025, designed for traders worldwide, including the USA, UK, Canada, and Australia.

- The tests we have conducted to find the top-performing platform are our own and are based on 50 different crypto exchanges that offer leveraged products.

- Anton, an expert on leverage trading, has tested and reviewed all the platforms in this guide.

After the recommendations, there will be an in-depth review of each platform, where you can see more of the specific features they offer.

List of Top Platforms for Trading Crypto with Leverage

Here is a quick look at the list for those who want a fast comparison of the platforms:

Best Overall

Our rating: 5.0/5

#1 BYDFi

Highest Leverage

Our rating: 4.9/5

#2 BTCC

Our rating: 4.8/5

#3 Phemex

Our rating: 4.6/5

#4 Binance

Our rating: 4.5/5

#5 PrimeXBT

Our rating: 4.5/5

#6 Bybit

Investment and affiliate disclosure: This article contains affiliate links, meaning we may earn a commission at no additional cost to you if you click our links. Trading cryptocurrencies and leveraged products carry significant risks, including potential losses exceeding your initial investment. The information provided is for educational purposes only and not financial advice. Please trade responsibly and seek professional guidance if needed. Read our full affiliate disclosure here.

Comparison of the best cryptocurrency trading platforms with leverage

| Leverage | KYC | US Trader Acceptance | Available Coins | Trading Fee | Regulation | Demo Account | Trading Interface | Security Features | Payment Options | Liquidity | Order Execution Speed | Unique Features | Cons | |

| BYDFi | 200x | No | Yes | 650+ | 0.02% | Regulated (FinCEN) | Yes | Modern, TradingView Charts | 2-FA, Email Verification, Withdrawal Whitelist | Fiat & Crypto | High | Super Fast | Stop-loss/take-profit in interface, fiat conversion in charts | No phone support, no news source |

| BTCC | 500x ( on major pairs ) | No | Yes | 500+ | 0.045% | Regulated | Yes | Advanced, Risk Management Tools | Google Authenticator, Fund Password, Withdrawal Whitelist | Fiat & Crypto | High | Very Fast | Automatic colalteral adjustment, high volume trader-friendly | Automatic collateral adjustment, high volume trader-friendly |

| Phemex | 100x | Yes | No | 450+ | 0.045% | Regulated (MSB) | Yes | Customizable, TradingView Charts | 2-FA, Trading Engine Safety Protocol | Fiat & Crypto | Good | Fast | Customizable UI, many order types | Steep learning curve, non-regulated |

| Binance | 125x | Yes | No | 800+ | 0.10% | Non-Regulated | No | Beginner-Friendly, Multiple Interfaces | 2-FA, Withdrawal Whitelist, KYC | Fiat & Crypto | Very High | Very Fast | Tutorial videos, leverage brackets | Withdrawal fees, complex fees |

| PrimeXBT | 200x | No | Yes | 20+ | 0.04% | Regulated (ASIC) | No | Multi-Charting | SSL, Cold Wallet, Google Authenticator | Crypto | Good | Fast | 4-asset charting, multi-market interface | Few altcoins, intimidating interface |

| Bybit | 100x | Yes | No | 200+ | 0.10% | Non-Regulated | No | Advanced, Feature-Rich | Fund Password, SMS Authentication, Whitelist | Fiat & Crypto | High | Very Fast | High liquidity, liquidation calculator | No demo account, non-regulated |

Find the Best Crypto Leverage Trading Platform

Answer a few quick questions to get a personalized recommendation.

1. Where are you from?

2. Do you want to file KYC documents?

3. What is your preferred leverage?

4. What is your maximum acceptable trading fee?

5. What type of trader are you?

6. Do you prefer to trade on Desktop/Webtrader or Mobile?

7. How important is a professional trading interface?

1. BYDFi: Top crypto leverage trading platform overall

Ranks number 1 of 5 with a rating of 5.0/5.

Overview

BYDFi, established in 2020, is the best crypto leverage trading platform overall in the USA, known for its regulation and user-friendly features. It has its headquarters in Singapore but operates in all corners of the world, including the United States.

BYDFi is regulated by FinCEN in the United States and is considered to be the most reputable US crypto exchange with up to 200x leverage.

The platform features over 400 altcoins and many of them are available to trade with leverage.

As well, there is no requirement to go through the KYC process when you sign up which makes the registration quick and easy.

In addition to this, BYDFI offers several different products to trade cryptocurrencies, including COIN-M pairs, Perpetual futures contracts, USDT-M futures, and Inverse perpetual contracts.

In August 2023, BYDFi integrated Alchemy Pay as an on and off-ramp for crypto investors who want to either deposit or withdraw with fiat money.

Keep in mind that BYDFi also offers leverage trading through their demo account where you can test out your most effective strategy before going live with real money.

At a glance, BYDFi is a regulated crypto exchange that offers leverage in the US and globally, has a strong trading platform, and has a wide range of trading options for all types of traders.

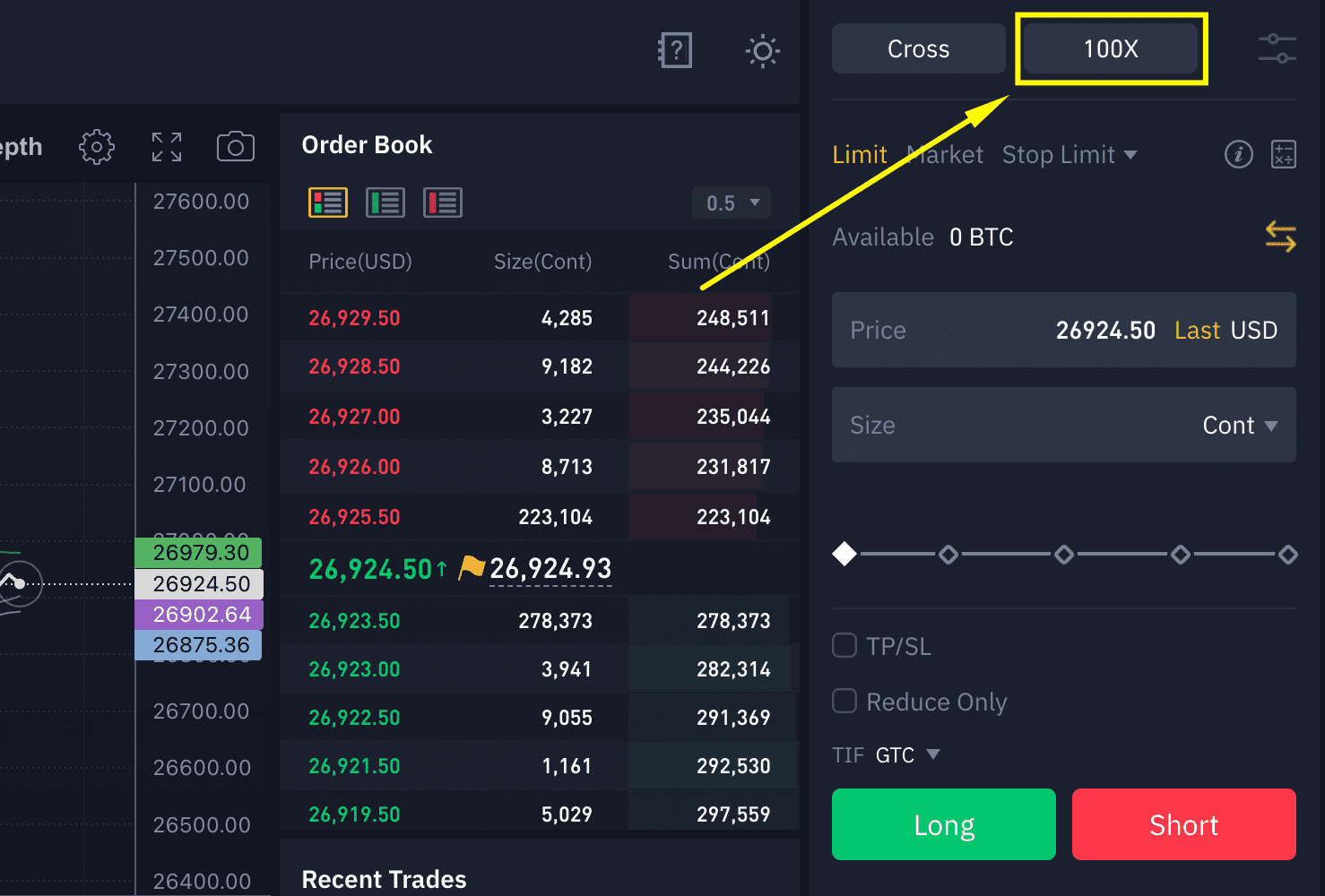

Leverage on BYDFi

BYDFi allows high leverage of up to 200x, making it easy for traders to adjust their crypto leverage ratio directly within the interface.

The maximum ratio offered on BYDFi is 200x but the option to trade with less leverage is easily accessible through the bar inside the trading interface.

The screenshot below shows exactly where to change the colalteral inside the trading platform.

Simply click the button and then choose your preferred ratio.

The optimal leverage for beginners is typically between 10x and 100x leverage depending on how comfortable you are with taking risks.

A higher leverage ratio always increases both the potential for profit and loss.

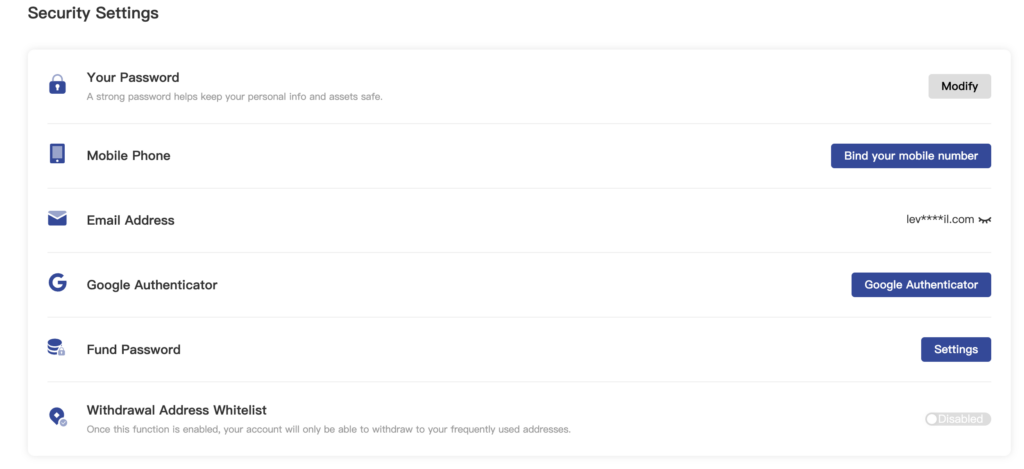

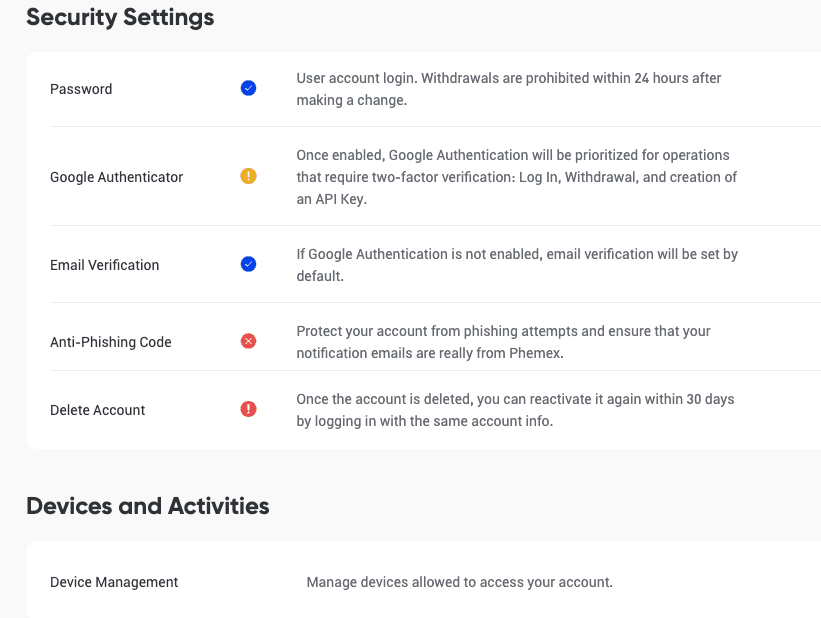

Security

BYDFi is regulated in the US as a Money Service Business which gives me a feeling of security knowing that one of the biggest watchdogs is looking over their shoulder.

Few established platforms in the United States offer leverage-traded products and BYDFi is trying to break the barrier safely.

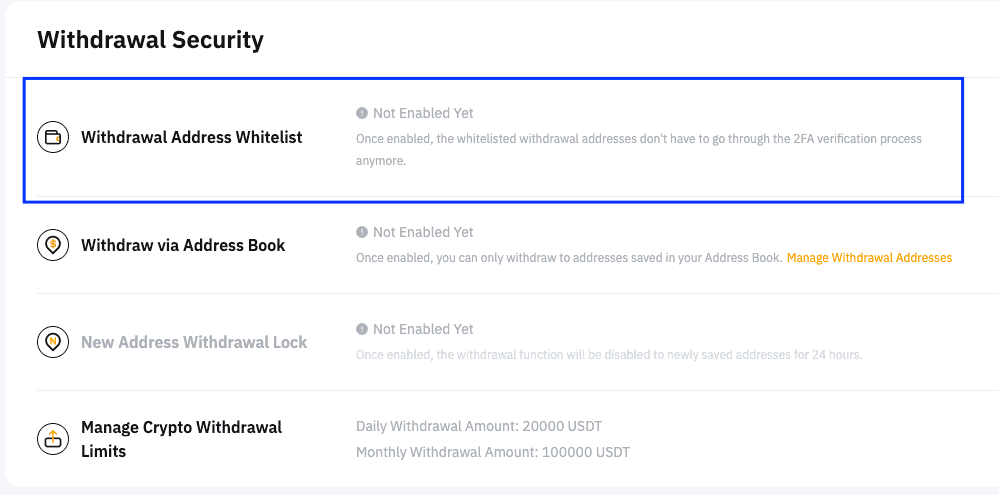

Other important security features include 2-FA, email verification, fund password, and other advanced safety measures such as withdrawal address whitelisting and phone number verification.

All of these security features are not enabled when you first sign up.

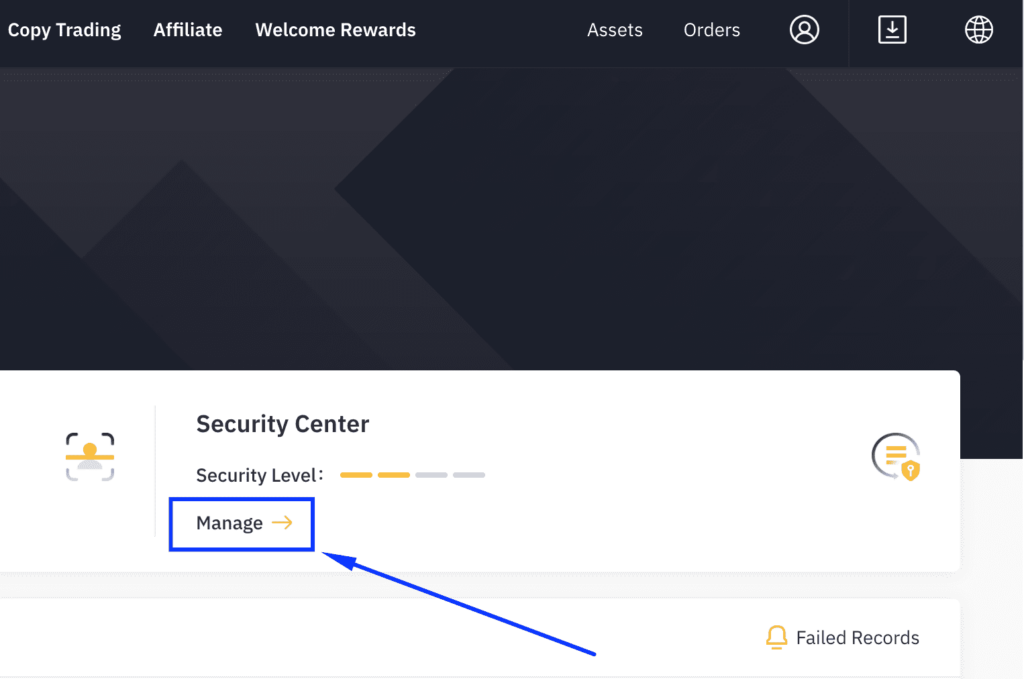

You have to go to the security page as you can see on the screenshot below to enable these features.

Once you enter the security page you can toggle on each feature.

In my experience trading on BYDFi, I’ve always used the Google authenticator to protect the account against immediate threats.

Enabling the withdrawal address whitelist is also a great way to make sure that your funds can only be withdrawn to your wallet addresses.

Trading fees

One of BYDFi’s standout features is its low trading fees, making it a competitive choice for leveraged trading.

The leverage trading fee on BYDFi is 0.050% when using market orders.

This goes for both opening and closing trades.

Check the explanation that BYDFi gives on its trading fee page:

Now, the transaction fee for leveraged tokens on BYDFi is slightly higher at 0.20%.

This has to do with the lowered ratios offered through these contracts.

BYDFi also charges a management fee of 0.03% every day at midnight.

This means that a total value of 0.03% of all leveraged positions will be charged from your trading account every day you keep positions open overnight.

Liquidity and order execution

BYDFi has an order book that has extremely high liquidity which is a huge plus and it lets you trade very large positions even if you are a scalp trader.

During our testing, we managed to easily enter and exit with position sizes worth over $100,000.

Here is a screenshot from the live order book at BYDFi in the COIN-M futures contracts.

The first buy order is worth $118,480 and the first sell order is worth $59,892.

The spread in this trading pair was $0.20 which stayed the same and even lower during our assessment of BYDFi.

This is a very favorable spread.

User interface and available trading tools

BYDFi strikes me as one of the most modern exchanges and my experience is that the designers of the platform are traders themselves.

The charting interface is distributed with the indicator tab to the left and the order execution and order book to the right.

The charting interface is powered by TradingView charts which ensures charts are 100% free from lag.

Here is a screenshot of the whole trading interface.

The feature that stood out to me while analyzing the BYDFi platform was the option to convert, transfer, or buy crypto directly from the charting interface.

In the bottom right corner of the trading platform, you can swap, buy crypto with fiat money, or convert your cryptocurrency for any other asset on the platform without leaving your trading setup.

The option to go long and short can be done with just one click once you have entered the charting interface.

Another thing I found very useful is the option to choose between cross and isolated margin.

The difference between leveraging your trades with cross and isolated margin is how the crypto leverage trading platform can access your collateralcolla capital.

Isolated margin is the safer option and keeps the collateral capital limited to one position only to prevent a full account liquidation by leverage.

Pros and cons

| Pros | Cons |

| Lowest fees | No customer support phone number |

| Offers up to 200x crypto leverage | No crypto market news source |

| Stop loss and take profit orders directly in the trading interface |

2. BTCC: Best Exchange for Highest Leverage

Ranks number 2 out of 6 with a rating of 4.8/5.

Overview

BTCC, a high-leverage crypto exchange established in 2011, is one of the longest-serving crypto exchanges globally.

This is all for good reasons because BTCC is licensed in the US, Canada, and Europe, allowing traders from nearly any country to sign up and trade.

BTCC solves a very common problem for US traders which is where to trade crypto futures in the USA.

With high leverage ratios of up to 500x for Bitcoin trading, lower fees than most other similar platforms, and a state-of-the-art trading interface, BTCC made it to the top of our list after thorough reviewing.

Some of the most popular contracts traded on BTCC are crypto perpetual contracts denominated in USDT and Coin-M perpetual crypto pairs denominated in other cryptocurrencies, all available for traders in the US and Canada.

On top of this range of products, BTCC also offers copy trading and a risk-free demo platform for beginner traders where strategy testing and platform testing are highly popular.

Leverage on BTCC

BTCC is known for being an exchange that offers the highest leverage ratios for crypto in the USA of up to 500x for major pair contracts.

To be able to trade with this type of collateral on the platform you should visit the perpetual market and look for either BTC, ETH, DOGE, or XRP which are the offered cryptocurrencies for this type of leverage.

Keep in mind that the platform is restricting these ratios to certain days and it is not available on the platform at all times.

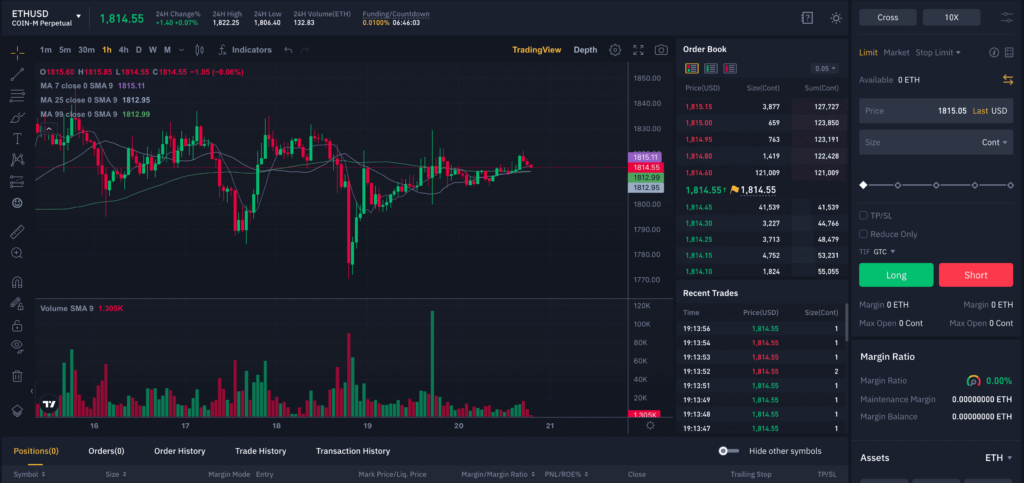

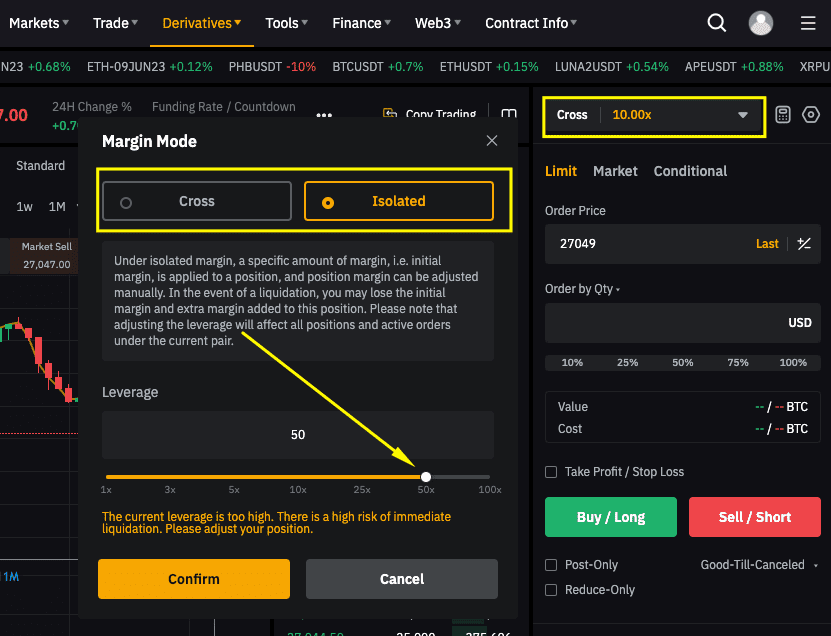

In the screenshot below which I took while trading on the platform, you can see how to change your margin in the trading interface:

Click the highlighted bar and choose the leverage ratio you want.

BTCC has an inbuilt risk management tool that automatically switches from crossed margin to isolated margin when you increase the ratio.

This is to protect your account from using up all the funds you have deposited in case one of your trades goes wrong.

This is a premium feature that I like and I haven’t seen it on other similar platforms.

Security

BTCC is very focused on security and through the account security page, you can choose to activate several different features to improve the safety of your trading.

First of all, the exchange will ask you to identify yourself by going through the KYC process.

However, this is not a requirement, you can trade crypto with leverage without KYC on BTCC if you wish to be anonymous.

Here are some of the important security tools I found on the exchange while doing the review:

Listed above are:

- Your password

- Mobile phone binding

- Email address

- Google Authenticator

- Fund password

- Withdrawal address whitelist

These protocols will help you protect your account against most threats and I highly suggest that you activate all of them, especially the Google Authenticator.

This makes BTCC a highly secure crypto leverage trading platform for US and Canadian traders.

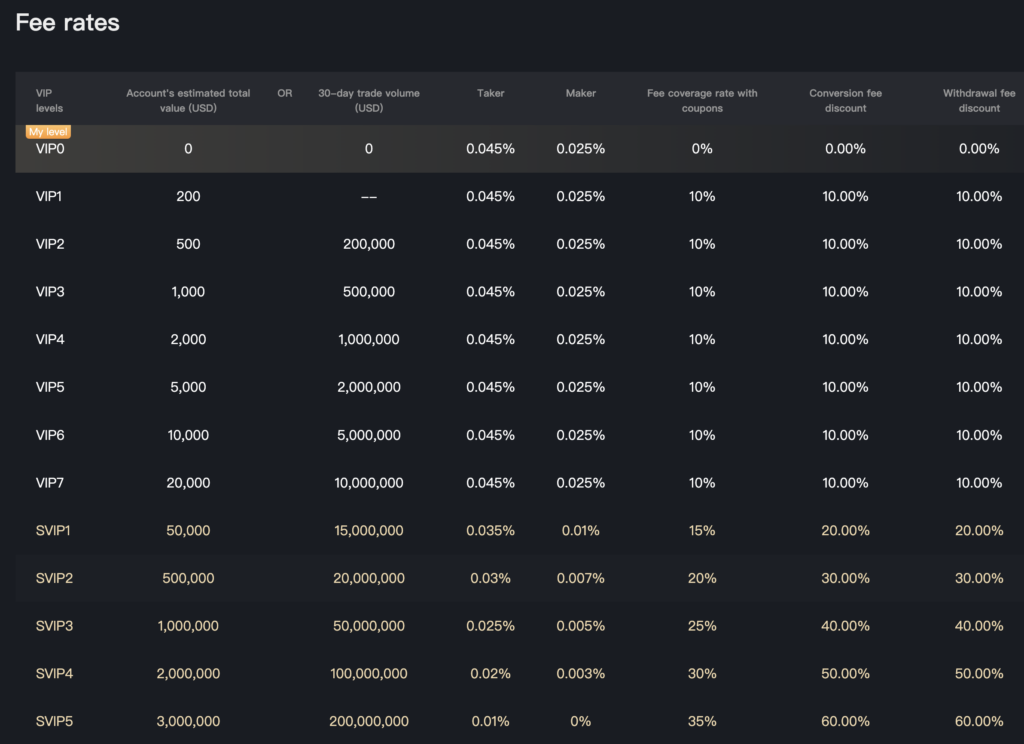

Trading fees

Let’s go through all there is to know about trading fees on BTCC.

The platform does not differentiate on spot trading and crypto contract trading and has therefore chosen to use the same fee structure for all trading, which I think is a good idea.

Below is a screenshot of the fee table I found while reviewing the exchange:

Trading fees on BTCC start at 0.045% for takers (market orders) and 0.025% for markers (limit orders) and scale down from here depending on your trading volume.

The trading fee is greatly reduced with volume which is something that favors traders who trade large position sizes which is easy to do on BTCC thanks to the high leverage ratios.

This favors traders who are going to maximize the leverage-ratios, and the first reduction in fee starts at $15,000.000 monthly trading volume.

This will reduce your trading fee by 0.010% for market orders and 0.015% for limit orders which is a big deal in terms of how much money you stand to save.

You can also decrease your trading fees by keeping a high value in your trading account. For example, if you deposit $50,000, you’ll be rewarded the first VIP level without trading.

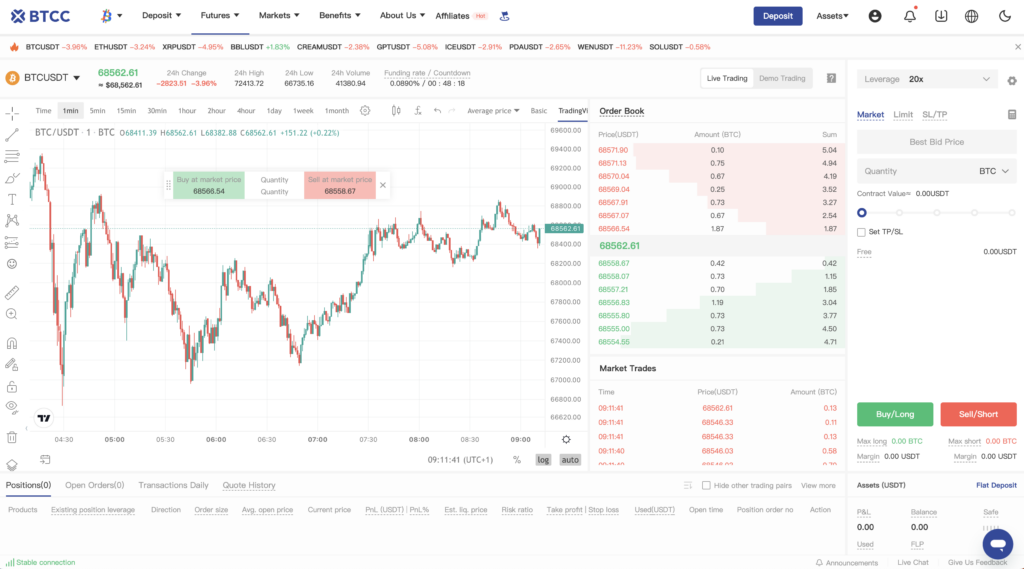

Trading interface and tools

The most interesting part of the BTCC exchange is the trading interface and the tools it offers.

The exchange is made for both beginners and advanced traders and offers a full suite of trading tools such as:

- TradingView charts

- Stop loss/Take profit orders

- Demo trading

- Copy trading

- Live order book

- Live order history

- Best Bid Price

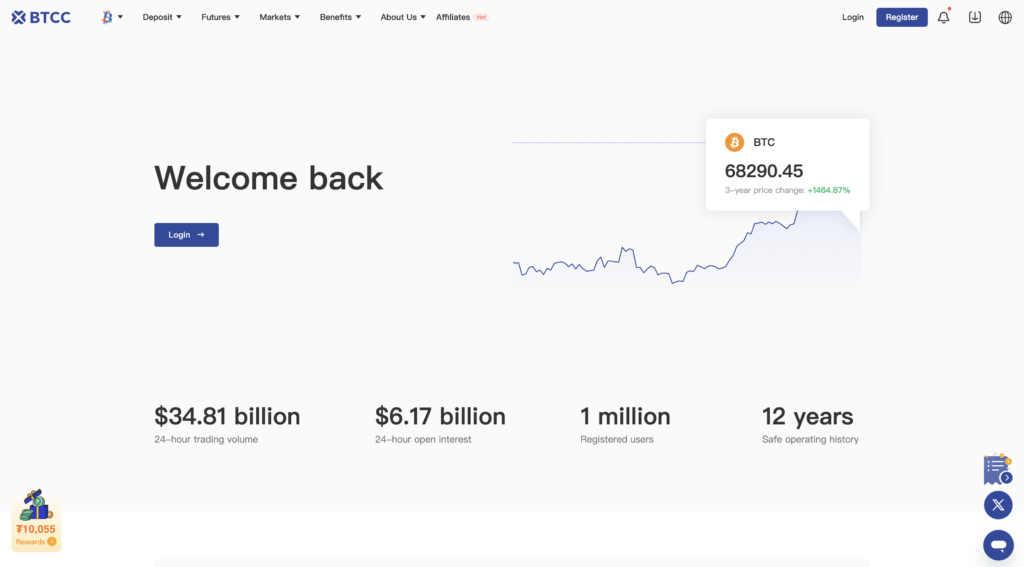

Below is a screenshot of the trading interface on BTCC that I took while reviewing the platform:

The features that stood out to me were the estimated liquidation price tracker which tracks your liquidation price live.

This is a great risk management tool that most other competitors don’t offer.

Your risk ratio is also indicated on a per-position basis which means that the platform will calculate your total risk ratio for all the open positions, which greatly reduces the risk.

BTCC does of course all the technical tools you might need including all technical indicators which can be located at the top of the TradingView chart.

While I was doing my test-trading on BTCC, I found that the order-matching engine was faster than platforms like Bybit and Binance, this impressed me.

It seems like the team behind the exchange has made it easier for day traders to trade crypto with high leverage to avoid slippage during trading.

The latency was also phenomenal, I didn’t experience any type of lag while trading, even during periods of high volatility, so creds to the BTCC team for optimizing the interface for high-speed trading.

Pros and Cons

| Pros | Cons |

| Highest leverage crypto exchange | High risk trading |

| Lower fees than most competitors | You can’t choose isolated margin on your own |

| Available for US and Canadian traders |

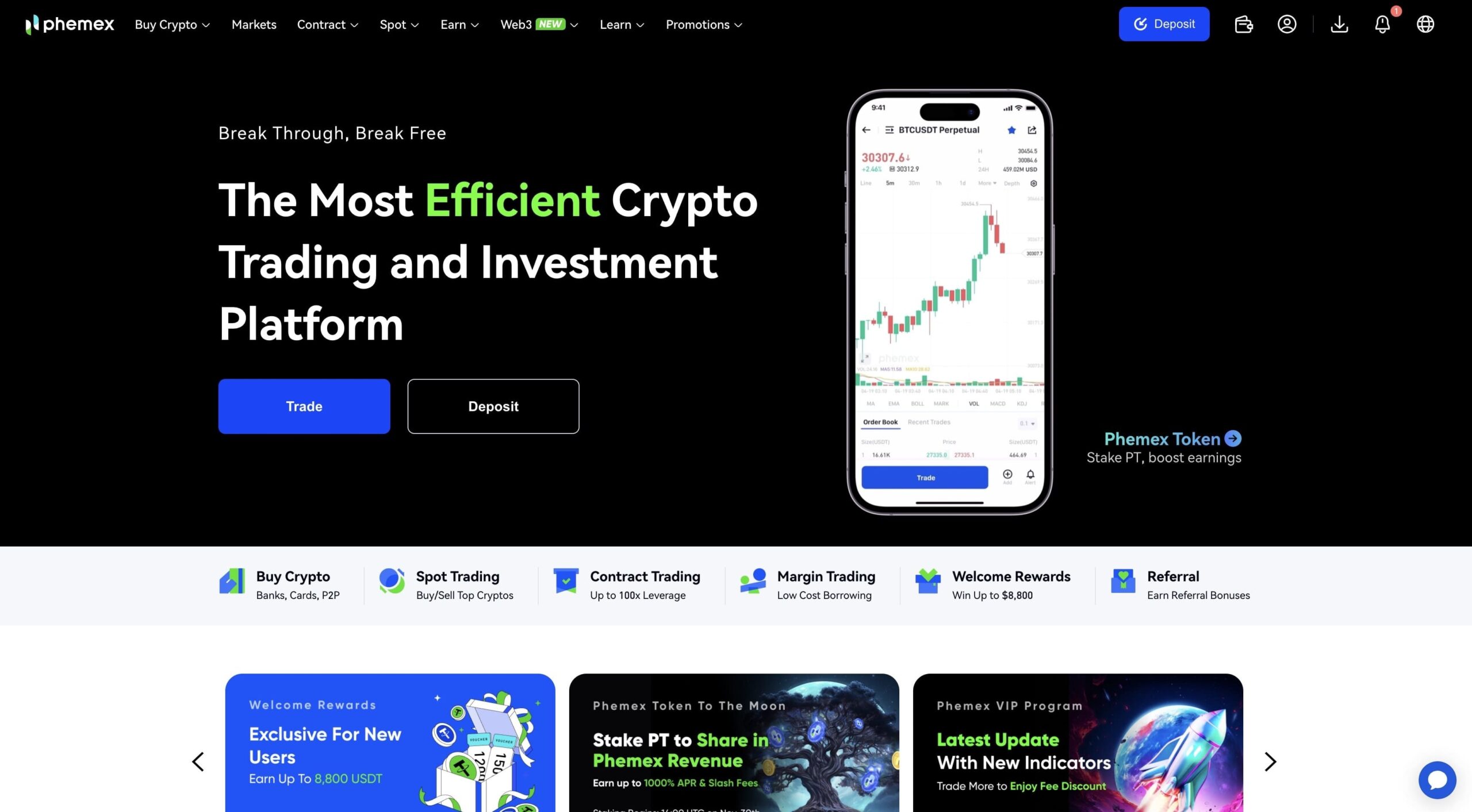

3. Phemex: Leading trading app for leverage trading

Ranks number 3 out of 6 with a rating of 4.7/5.

Overview

Phemex is a reliable platform for traders seeking up to 100x leverage for face-paced trading, especially for mobile users. Its straightforward interface and versatile trading tools make it a strong contender for leverage trading.

Phemex offers trading through perpetual contracts with USD, cryptocurrencies, or USDT as trading collateral.

On Phemex you can make your deposits with fiat money in an instant using credit cards, debit cards, Apple Pay, Bank Transfer, and several other minor payment methods.

The exchange sticks out to me as a new and modern platform with plenty of trading tools for traders who are looking to boost their capital.

Phemex is headquartered in Singapore making it a global exchange and is registered as a Money Service Business in the United States which adds to its legitimacy.

The platform offers a large variety of tools for short-term scalpers or day traders through advanced charting interfaces, stop losses, take profit orders, and a lightning-fast order matching engine.

The order book is always full of liquidity which is good for users since there will always be someone on the buy and the sell side to meet your trade.

Leverage on Phemex

Phemex offers perpetual crypto contracts with up to 100x leverage.

You can access these contracts by first allocating a small percentage of your capital as a fiat or cryptocurrency deposit.

On the Phemex leverage page, they explain how they adjust their liquidation price based on the level of leverage, and the more buying power you use the smaller the distance between your entry price and the liquidation price

The leverage is available through both cross and isolated collateral which gives traders different options on how they want to allocate their account balance.

Security

See the image below for a detailed description of the Phemex security page.

In addition to this, Phemex operates with a trading engine safety protocol to match clients’ orders based on price and time.

This engine is responsible for doing a quick risk analysis of the trading account of each trader.

These checks include:

- Costs

- Fees

- PNL

- Computing in real-time

This is to make sure that no trader is taking on too much risk without being fully aware of the situation.

I found it very useful when I tested the Phemex exchange as it enables for up to 10x faster trading even in volatile market conditions.

Trading fees on Phemex

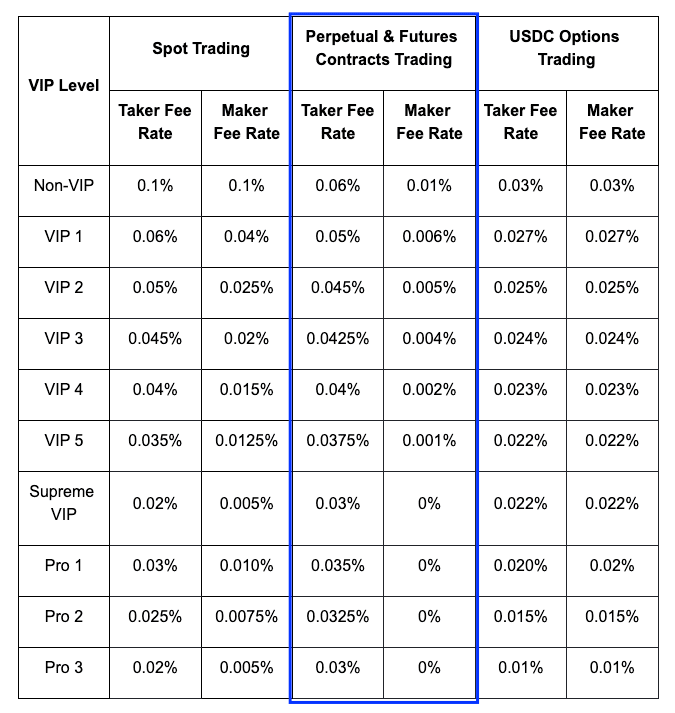

Phemex offers fees of 0.06% for takers without VIP status.

The market fee is slightly cheaper at 0.01%.

As your trading volume increases the trading fee gets reduced according to this table taken from the Phemex fee page.

Below is a screenshot of the Phemex fee page to illustrate the costs.

The lowest possible fee you can acquire through the VIP system is 0.0325%.

In comparison to other competitors, it’s rather cheap.

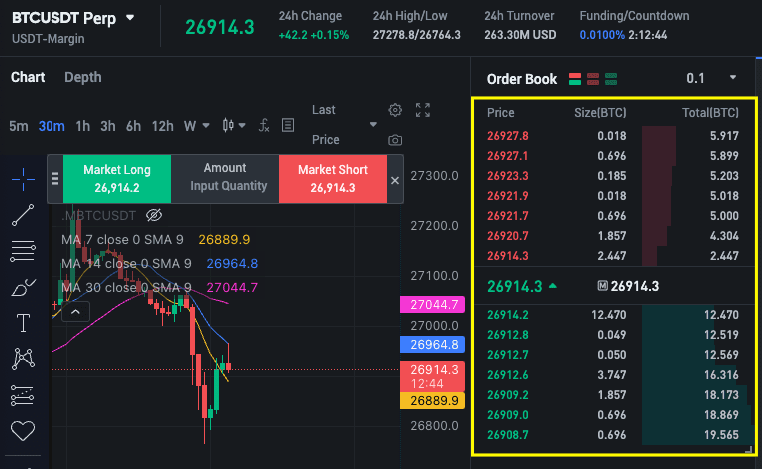

Liquidity and order execution

The liquidity on Phemex is slightly lower than other competitors.

However, when conducting live testing on the platform, I found now problem entering and exiting the market with $100,000 lots.

Below is a screenshot from the Phemex order book from when I analyzed the liquidity.

During my testing period, there was a bullish pressure in the market which can be seen in the buy side of the order book.

The first buy block was worth roughly 12 Bitcoins which is not a low number by any means.

Throughout the trading session, it stayed stable at around 12 to 15 Bitcoins on both sides of the order book meaning.

This means that traders can easily enter and exit with leveraged positions of up to $400,000 without any slippage.

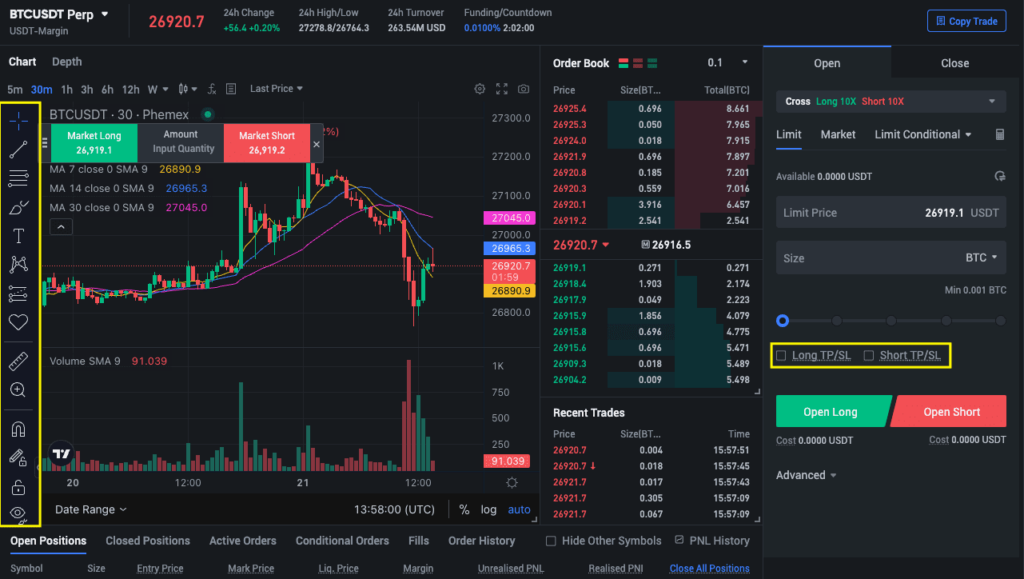

User interface and available trading tools

The charting interface is very manageable and there are different options when it comes to the layout of the chart.

You can choose between having the chart on the right or the left side with the order selection and order book on the opposite side.

It’s also possible to deactivate parts of the trading interface.

For example, if you would like to disable the recent trades box to open up more space, that’s an option.

In the image below, I’ve highlighted the stop loss, take profit, and the drawing tool area that I used when assessing the platform.

A tip that will help you along the way that I used frequently was the advanced option below the Open Long and Open Short buttons.

This will open up a new tab where you can choose between more order types such as GTC, IOC, and FOK.

Pros and cons

| Pros | Cons |

| Great tools for day traders | Non-regulated |

| Demo account | The platform has a lot of functionality that takes time to learn |

| Options to buy crypto with fiat vendors |

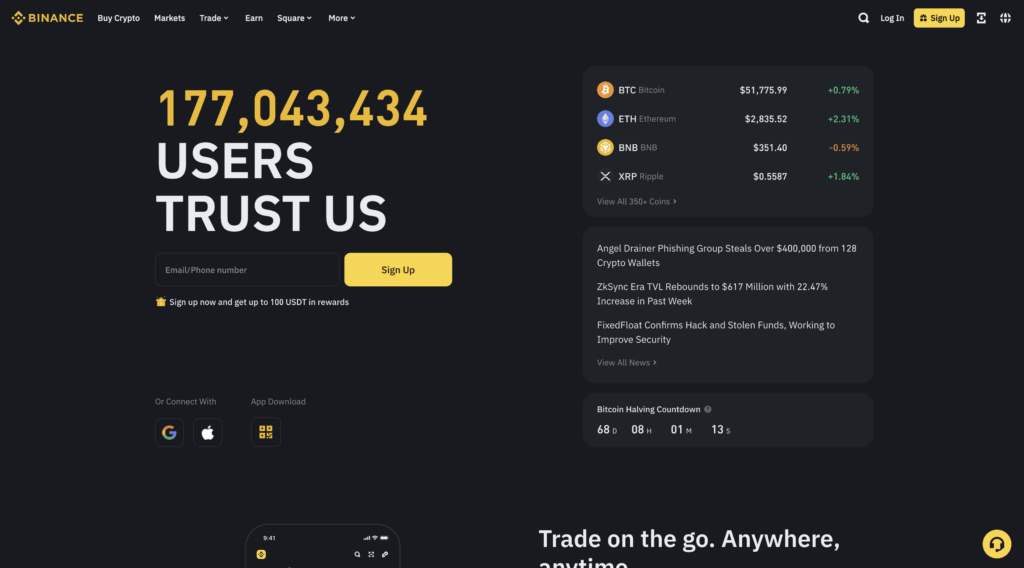

4. Binance: Ultimate platform for trading crypto derivatives

Ranks number 5 out of 6 with a rating of 4.6/5.

Overview

Binance is known as the best platform to trade derivatives, especially for altcoins, thanks to over 600 coins listed on the platform, where many of them are available to trade with leverage.

With nearly $40 million of daily trading volume and nearly 600 cryptocurrencies listed, Binance is the perfect platform to trade altcoins with leverage and amplify returns.

It is seen as one of the most trusted non-regulated exchanges on the market and it has won several awards.

A small setback for the giant was that in 2020, FCA from the UK banned crypto platforms from offering crypto-derivatives to UK investors which shrunk the overall client base by a couple of millions.

However, the platform often gets recognized by its users on community forums such as Reddit where a user explains why he likes Binance, particularly due to the ease of use.

Binance supports several different fiat payment methods and pretty much all major currencies which makes depositing super easy.

The exchange is only about 5 years old and was first launched back in 2017 during the big bull run when Bitcoin hit $20k for the first time.

Binance is a popular choice among many beginners due to low trading fees, a great variety of trading assets, a state-of-the-art charting interface, and bank-grade security.

Leverage on Binance

Third on our list is Binance which offers a maximum ratio of 1:125.

Binance has a positioning bracket that prevents traders from overleveraging.

It works by lowering the ratio when traders take larger and larger sizes.

This makes sense since the risks of leverage increase the risk of loss.

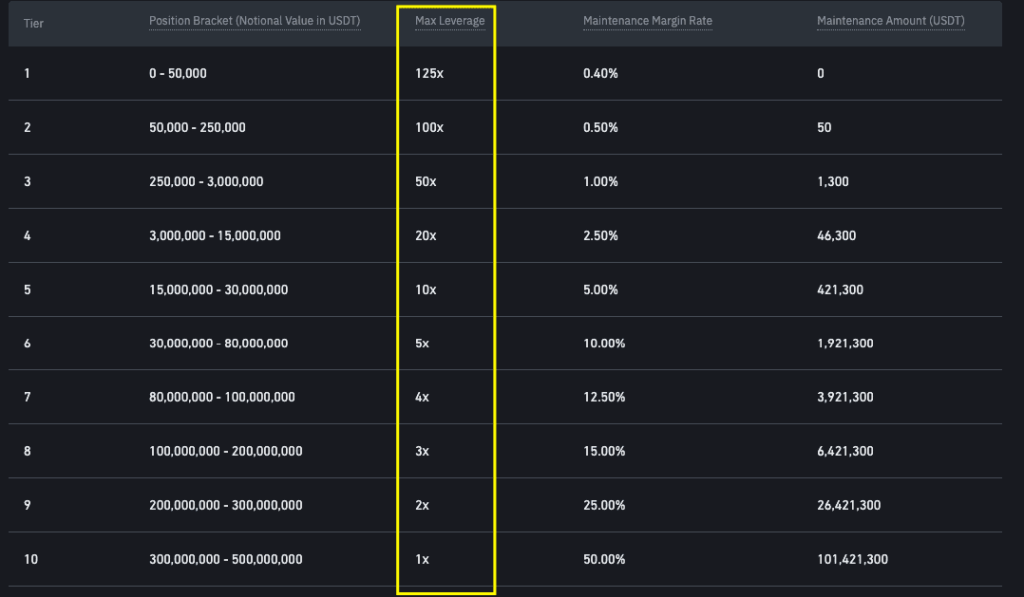

Below is an image of the positioning bracket and how much buying power you are allowed to use for each position size.

I have highlighted the leverage bracket to showcase how the ratio changes as you increase your position.

The rule is different for every asset which has to do with the individual volatility of each coin.

As I was assessing the platform, I found this very useful, especially when trading larger trades.

Security

The security is very strong on Binance and is considered one of the safest non-regulated platforms which is why I’ve been using their services for the past 5 years, it makes me feel safe knowing that my coins are stored offline and my account is protected.

Through their security page, you can enable several different security features that will instantly protect your account against outside threats.

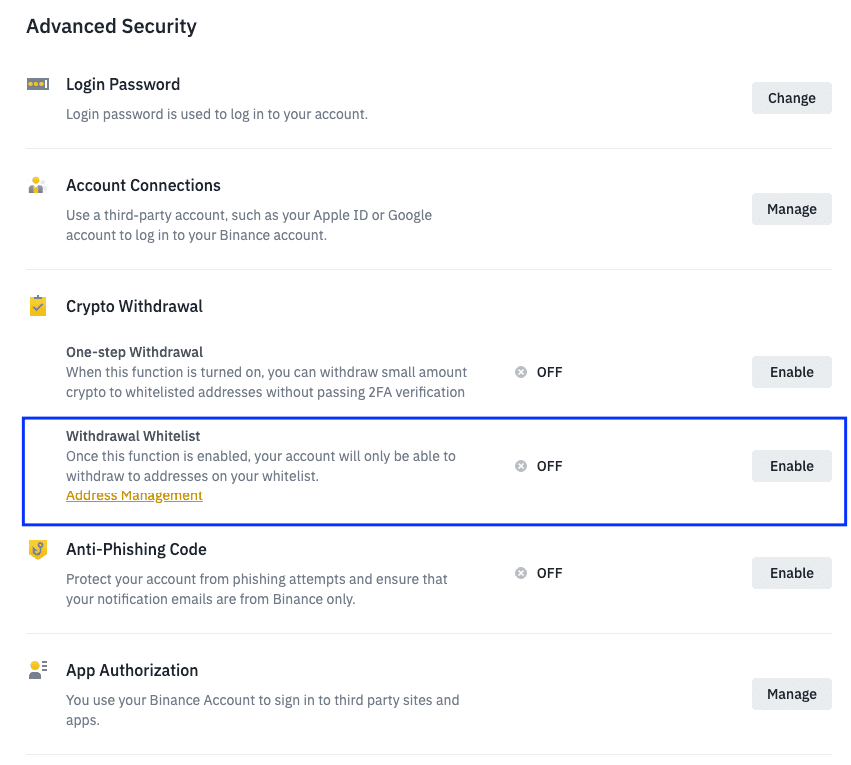

Except for all the standard security features such as 2FA verification codes and phone number verification, Binance also offers advanced safety features as seen in the screenshot below.

I have circled the withdrawal whitelist option because I think it’s a very useful tool to prevent hackers from ever leaving the platform with your funds.

The third-party account connection is also a very useful feature that I used when I analyzed the platform.

It lets you connect Binance to either your Apple ID or your Google account for an extra security layer.

Binance also adheres to strict KYC and AML rules and all traders are obligated to identify themselves before starting.

Trading fees

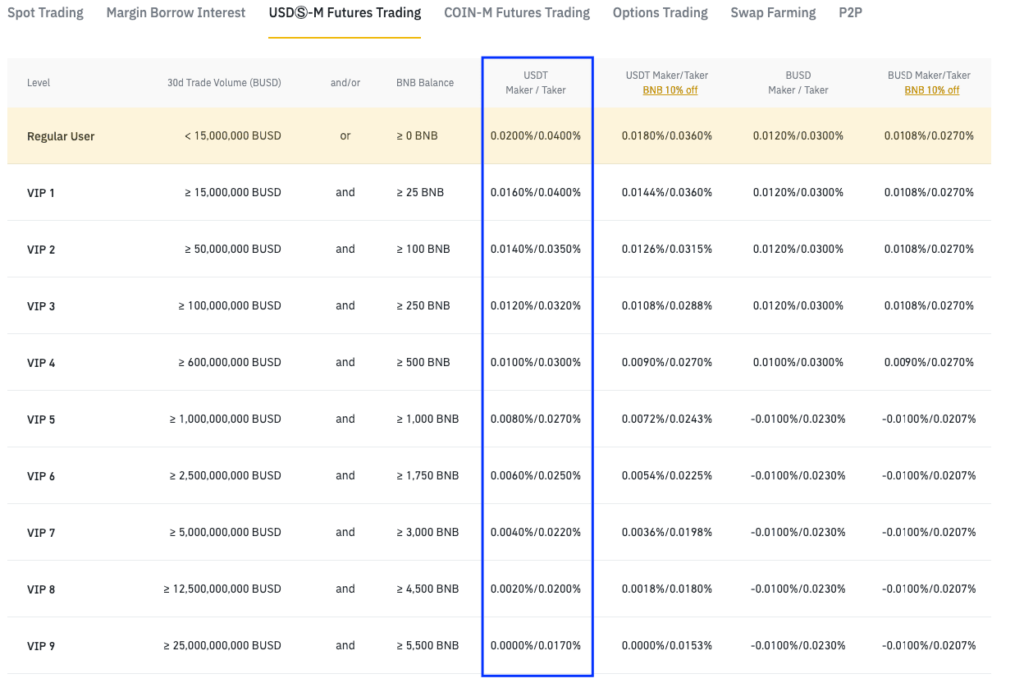

Binance has a complex trading fee structure, but competitive, that traders should be aware of as you can see below.

I’ve highlighted the trading fee I used when I was testing the platform which was in the USDS-M trading.

Depending on your chosen market you will be given a certain transaction fee.

For example, USDS-M pairs on Binance have a basic trading fee of 0.04% for taker trades.

However, if you choose to trade with the native coin BNB there is a 10% cut to the rate.

Additionally, if you trade with the native stablecoin on Binance called BUSD, your fee for opening trades as a market taker is 0.03%.

Liquidity and order execution

Liquidity on Binance is as good as it gets and it is currently ranked as the crypto exchange with the highest volume.

Getting in and out of positions on Binance even with huge leveraged positions is not a problem.

When testing the platform I could easily scalp trade the BTCUSDT perpetual contract with $100.000.

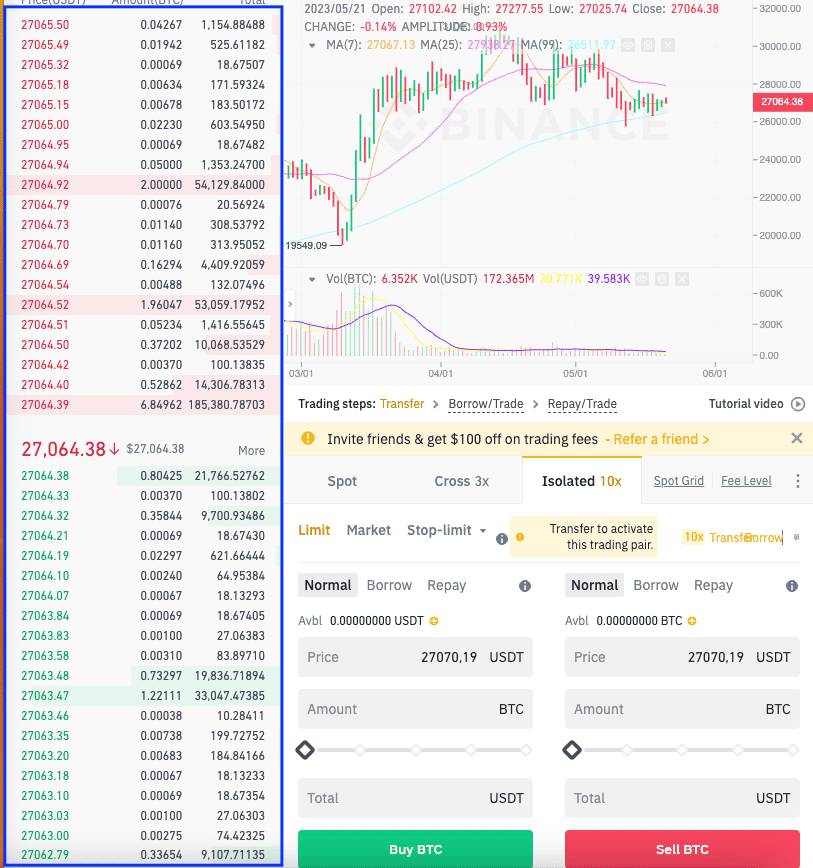

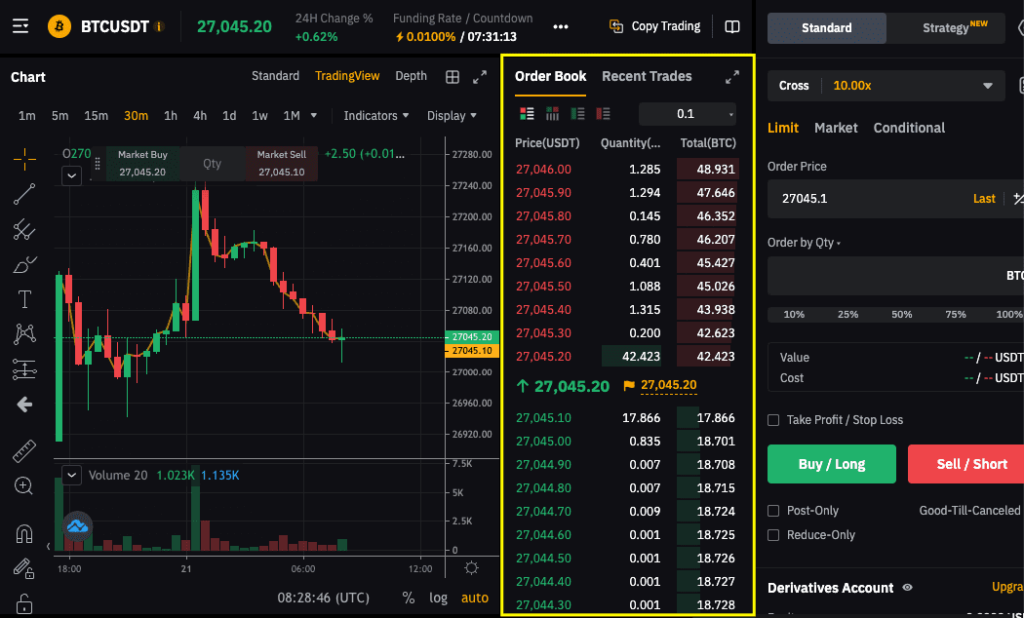

Here is a screenshot from the order book liquidity.

As seen above, the first buy order is worth $21,766 and the first sell order is worth $185,380.

User interface and available trading tools

Binance is very easy to navigate and a great choice for beginners thanks to the several different interfaces they offer.

The trading interface looks different the most other platforms.

Binance has chosen to include a smaller chart from TradingView while focusing on the order book and the market trades.

All necessary trading tools are available such as:

- All timeframes

- Trading indicators

- Open orders in the chart

- Depth chart

- Limit, market, and stop-limit orders

- Access to all trading pairs

Something that Binance also has incorporated into its trading interface is a beginner tutorial video that I watched before I started testing the exchange features.

It’s professionally made and will teach you the basics of the platform.

Where to trade altcoins with leverage?

To trade altcoins with leverage your best option is to sign up with Binance which is known for its massive list of altcoins that are available to trade with up to 100x.

Altcoin trading works the same way as any other cryptocurrency that you can find on the platform.

To trade altcoins with leverage, follow these steps:

- Sign up with Binance.

- Make an initial deposit.

- In the main menu, hover over Trade.

- Click Leverage.

- In the right-hand side menu, select altcoin.

- Choose your ratio.

- Select position size.

- Add take-profit and stop-loss orders.

- Click Buy.

Monitor your trade and make sure you keep an eye on the liquidation price of the open position.

Pros and cons

| Pros | Cons |

| High leverage in for Bitcoin trading | Non-regulated |

| High volume and great liquidity | Withdrawal fees are expensive |

| Easy to use for beginners |

5. PrimeXBT: Great for high-volume bitcoin leverage traders

Ranks number 6 out of 6 with a rating of 4.5/5.

Overview

PrimeXBT is an excellent platform for crypto leverage traders, offering up to 200x leverage for crypto, 1000x leverage for other markets, and an ultra-fast trading interface. Open to U.S. users, it delivers a seamless experience tailored for high-volume, fast-paced trading.

Regulated by the Australian government agency ASIC, PrimeXBT is considered to be a highly secure platform in Australia.

The platform is built for fast-paced traders that move large volumes several times per day and order execution is the top-performing process on the platform.

The most popular coins to trade on PrimeXBT are Bitcoin and Ethereum making it a great platform to trade Ethereum with leverage.

I consider the platform to be an advanced choice for more experienced traders as the charging interface can be a little bit intimidating.

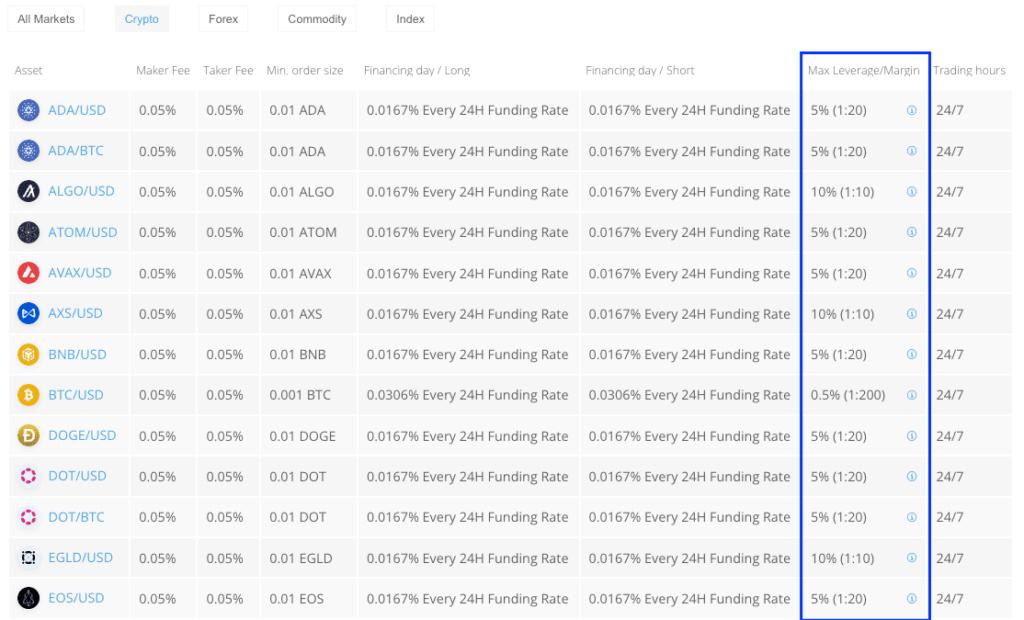

Leverage ratios

Each crypto asset has its ratio which can be seen on this page.

The max ratio for each asset can be seen on the right-hand side after you click Crypto in the top tab as seen on this screenshot.

PrimeXBT offers a maximum buying power of 1:200 in Bitcoin trading and a minimum of 1:10 in smaller crypto assets that are more volatile.

Security

On this crypto trading platform with 100x leverage, you can trade without KYC.

PrimeXBT has a withdrawal limit of $20.000 per day.

Other safety features on the platform include:

- Email notifications of sign-in, trade liquidations, trade margin calls

- Google Authenticator

- Government regulation by ASIC

It is considered a safe and trustworthy platform according to many reviews I read online.

Additional security features that are worth mentioning are SSL protection to protect your data and a cold storage Bitcoin wallet.

Trading fees

PrimeXBT is one of the top choices due to its low fee structure.

Leveraged trading fees are favorable on PrimeXBT and start at 0.05%.

There is a financing fee of 0.0167% that is charged for every trader who holds their positions overnight.

This goes for both long and short positions.

Below is a summary of the trading fees on PrimeXBT.

It’s worth mentioning that PrimeXBT notifies that their trading hours are always 24/7 for cryptocurrencies.

Liquidity and order execution

PrimeXBT operates with a market-making system that allows for uninterrupted trading no matter how large your trades are.

This is one of the big perks of leverage trading cryptocurrencies on this platform.

Traders who want to size up and trade larger positions will have no problem getting in and out of the market, even during high-volatility periods.

The order matching engine on PrimeXBT is of the latest technology and has so far proven to be error-free during our assessment of the platform.

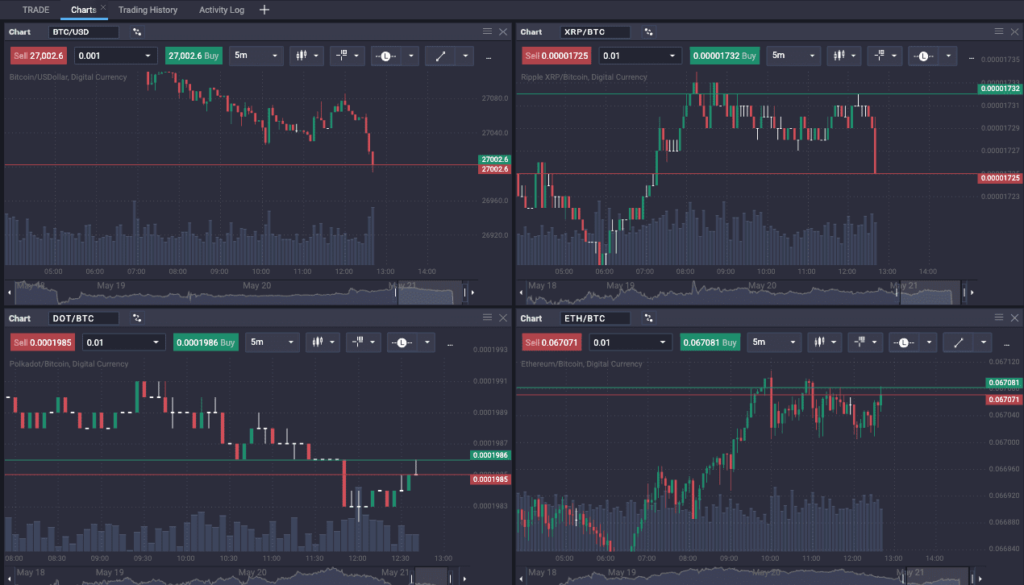

User interface and available trading tools

PrimeXBT offers a great trading interface and their flagship 4-chart trading platform is what attracts most users.

The multi-chart offers an overview of four different assets at different timeframes.

You can also buy and sell directly inside the chart giving you control over several different assets at the same time as seen in the image below.

This is a great trading tool for traders who are managing several positions at the same time and I don’t know any other platform that offers this feature.

You can also change the market and trading pair directly from the top of the chart.

All charts come built-in with market volume.

Should you want to focus on one chart at a time you can do that by clicking the Trade button in the top left corner.

From here you have more trading tools at your disposal such as all trade indicators, different chart styles, and drawing tools that are not offered in the multi-chart.

Pros and cons

| Pros | Cons |

| Great for high-volume leverage traders | Can be difficult for complete beginners |

| Great charting interface | Few altcoins avialble |

| Regulated by the Australian government | Slow charting interface |

6. Bybit: Top exchange for options trading

Ranks number 4 out of 6 with a rating of 4.6/5.

Overview

The best crypto options trading platoform is Bybit which offers up to 100x leverage and was launched back in 2018, one year after the big boom when Binance came to the market.

Recent data from Kaiko said that Bybit grew from 1% to 9% market share in 2023, making it one of the largest crypto exchanges to offer high leverage.

With over 10 million users, Bybit has become a household name on the cryptocurrency scene due to the vast variety of trading assets and products.

These assets range from options trading products to spot and investment-like vehicles.

Many reviews about Bybit in community forums often praise the platform for evolving with the crypto market and shaping the crypto landscape.

What caught my attention when testing the Bybit platform was the professional-grade trading and matching engine, which makes day trading extremely favorable.

Also, the competitive fees for both maker and taker transactions are among the lowest in the industry.

Leverage on Bybit

The Bybit crypto exchange offers 100x leverage which can be accessed through the derivatives contract BTC USDC Perpetual.

This contract is only trading Bitcoin against USDC and is the only way to access 125x on Bybit.

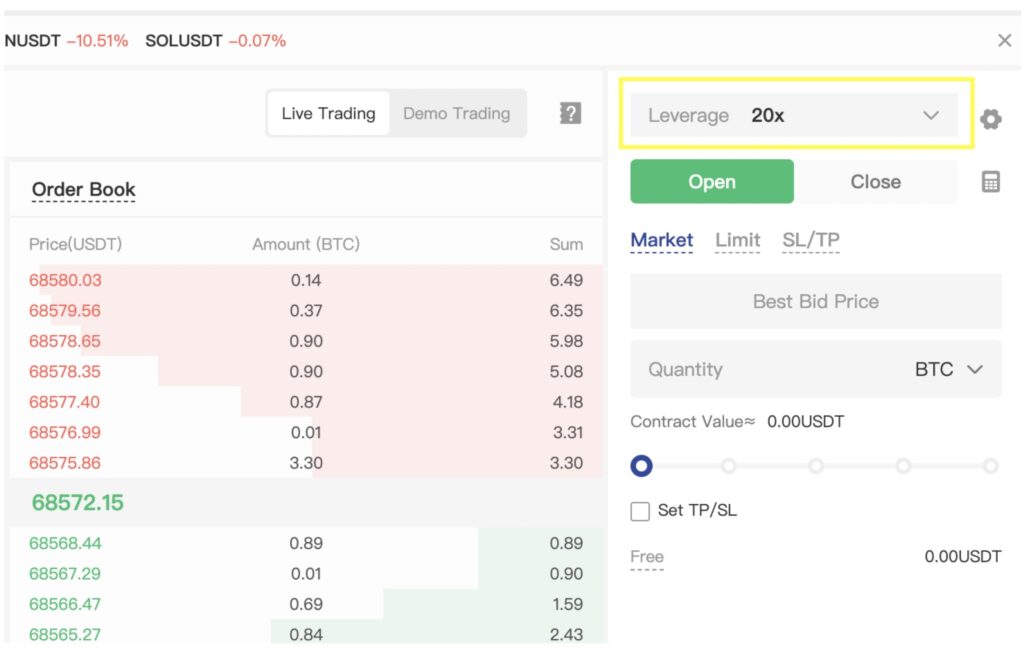

The rest of the contracts offer up to 100x leverage and can be found in the USDT perpetual, USDC contracts, and Inverse perpetual contracts.

As you can see on the screenshot below taken during the testing of Bybit, the exchange also offers both cross and isolated margin.

The arrow points to the bar where you can change the leverage ratio directly from the charting interface.

And in the top right corner is where you access the panel to swap between cross or isolated margin.

When choosing your position size and how much money to borrow on Bybit, I recommend using their liquidation price calculator to see where your liquidation price is before entering the position.

This feature can be found just to the right of the panel in the top right corner of the charting interface.

Security

Bybit is a very secure crypto options exchange even though the platform lacks government regulation.

Through their account security page, you have the option to enable several features to strengthen the overall safety of your account.

The fund password requires a password to move and transfer funds on the platform which prevents hackers from ever withdrawing your funds.

The SMS authentication feature is also very strong since you need to have access to your own mobile phone to make changes or send funds off the exchange.

The third security feature that I found very useful when analyzing the security of Bybit was the withdrawal address manager setting. Here you can save withdrawal addresses which will be treated as special addresses. Only these saved addresses can be used for a withdrawal, protecting you from potential attackers who would make withdrawals to their own wallet addresses.

I highly recommend enabling as many of these safety features to ensure that your account is 100% secure.

Trading fees

Bybit employs a trading fee system that rewards higher trading volume.

When you first join the platform you will start as a non-VIP member and your taker fee rate is 0.06% for leverage trading.

As you gradually increase your trading volume the trading fee starts falling.

The image below explains the full transaction table on Bybit taken from their website.

I have highlighted the leveraged contract fees in blue.

Liquidity and order execution

As a crypto leverage trading platform with high leverage that is competing with Binance for having the highest liquidity in the world, Bybit always maintains a high level of liquidity for all markets.

Even trades who trade large volumes will not have any problems with getting in or out of their traders at any time of the day.

Take a look at this image of the order book from Bybit.

The first sell order in the BTCUSDT trading pair in the Perpetual contract pit is worth 42 Bitcoins.

The first buy order is worth over 17 Bitcoins.

These numbers get even higher during high-volume periods during the day.

I found that between 08.00 and 10.00 European time was the period with the highest volume.

The period with the second-highest volume came in at around 15.30 in the afternoon when the American trading session started.

User interface and available tools

Bybit has a massive toolbox when it comes to trading tools through its trading interface.

Here are some of the best tools for active traders that I used when I tested the platform.

- Trendlines

- Pitchforks

- Brush

- Indicators (50+)

- Fib retracement lines

- Gann fan

- Parallel channels

This and plenty more are available through all charting interfaces on the Bybit exchange.

As I was analyzing the charting interface I took a screenshot to highlight some of the more important tools, take a look below.

Highlighted in the image are the toolset to the far left, the order selections in the top right corner, and the take profit and stop loss setting above the buy and sell buttons.

These tools are what make Bybit one of the optimal choices for traders with different trading styles.

Pros and cons

| Pros | Cons |

| Real stop loss and take profit orders | Non-regulated |

| Very high liquidity for leverage trading | There is no demo account on Bybit |

| Great trading interface for day traders |

The benefits and drawbacks of this platform are based on our own testing of the Bybit exchange.

What is crypto leverage trading?

Crypto leverage trading is a method where traders borrow funds to increase their position size in the market.

This strategy can lead to higher returns due to the amplified position size. However, the potential risks grow proportionally, as losses are also multiplied.

Leverage trading can be highly profitable when executed at the right time, but it remains a risky approach since the capital used is always at stake.

When using a high ratio in crypto trading it means that you are borrowing money on your margin collateral up to 100x of your initial deposit and sometimes more.

As with any leverage product, you have two parts to your trades:

- Margin capital = Your own money

- Leverage = The money borrowed from your broker

In a nutshell, when trading crypto with a multiplier you are essentially multiplying your account size with the chosen credit, for example, 1:100.

At 100x leverage, your potential profits and losses are greatly increased which calls for razor-sharp risk management to avoid large losses.

Both your wins and losses are amplified 100 times.

For example, if you were to trade Bitcoin with $500 without leverage and you scored an 11% profit, this would result in a $55 profit.

If you instead traded the same Bitcoin contract with a multiplier, let’s say 100x, your profit would be 100 times larger, $5500.

How does crypto leverage trading work?

Crypto leverage works the same way as it does in other financial markets where you need a broker that offers derivatives trading such as CFD, ETF, Swaps, or Futures. These contracts carry margin that will increase your position size.

The only thing you need to access leveraged products is the initial deposit which can either be deposited as cryptocurrencies or fiat currency.

Once your initial deposit is in your account you are free to choose from all the different products that are offered by the operator and open positions your chosen coin.

The added buying power you get when trading comes from backup funds that the owner provides. These funds are not yours to keep and you will only have access to them while you have an active position open in the market.

Once the position is closed, the borrowed funds are returned to the broker and the difference in profits and losses are split among you.

What the broker earns is the trading fee which is also increased due to the increased position size, you can read more about fees and commissions further down on this page.

When you make a profit with a leveraged position in crypto you either earn profits directly in the coin you are trading, for example, XRP, or you will get rewarded USDT which is a common stable coin that many traders use.

Pros and cons

Choosing a crypto leverage trading platform can significantly impact your trading experience, but like any tool, it comes with its advantages and drawbacks. Below, I’ll cover most important points to help you understand what works and what doesn’t when trading with leverage.

Pros

- Maximize your wins: This is something many traders overlook as they chase profits without focusing on efficiency. In trading, perfect setups are rare. When they appear, leveraging your position allows you to extract the maximum potential from those opportunities, ensuring you make the most of ideal market conditions.

- Accelerate account growth: For new or intermediate traders, growing an account can feel like an uphill battle. While leverage won’t magically turn a $500 account into $250,000 overnight, it amplifies the returns on profitable trades, providing the momentum needed to scale your capital faster.

- Expand your portfolio: One of the underrated benefits of leverage is the ability to trade more assets without requiring additional capital. Even at a 1:10 ratio, you can diversify your investments across multiple cryptocurrencies, reducing risk while maintaining exposure to a broader market range.

- Lower your risk per trade: Most traders fixate on the profit potential of leverage and forget its risk-reducing aspect. With leverage, you can allocate less leverage per trade, effectively minimizing the capital at risk. A balanced ratio, such as 1:2 or 1:5, keeps your liquidation levels manageable (between 50% and 20%) while still enabling significant trading power.

- Low capital requirement: Instead of needing a significant upfront investment, traders can start with smaller amounts and still open large leveraged positions. This accessibility makes leverage particularly appealing for beginners or those testing new strategies, as it allows them to explore the market’s potential without overcommitting funds.

Cons

- High risk of liquidation: While leverage can amplify gains, it also magnifies losses. A small market movement against your position can result in a complete liquidation of your funds. Use our liquidation calculator to figure your your liquidation levels.

- Risk of unlimited losses: While not all brokers operate this way, some lack safeguards to protect against losses exceeding your account balance. This means you could potentially lose more than you have. Always ensure your broker offers negative balance protection to avoid this serious issue. With crypto leverage trading, the risks differ from forex or stocks, as many platforms include built-in protection—make sure yours does.

- Underestimating leverage: Leverage often gives new traders a false sense of security, especially if their early trades are successful. Adding more credit to your positions after a few wins might seem like a natural progression, but it dramatically increases risk. For example, jumping from a 1:5 leverage ratio to 1:20 significantly lowers your liquidation threshold, leaving you vulnerable to rapid losses. Without careful planning, your account could be wiped out in seconds.

- Greed can take over: It’s easy to fall into the trap of greed when you see big wins with leveraged positions. The thrill of consistent, sizable gains can create the illusion that trading is effortless, leading to overconfidence. This mindset often results in poor decision-making and an inability to stick to a disciplined strategy.

- Overtrading: The promise of quick profits can push traders into a cycle of overtrading. The temptation to chase one big win after another is strong, but this approach often backfires. Increased position sizes come with higher fees, which quickly erode your trading capital. Without restraint, overtrading can leave your account drained faster than you expect.

Some other platforms that are worth mentioning for beginners looking for leveraged trading include Coinbase, Kraken, Bitstamp, KuCoin, and HTX. While they each cater to different types of traders, they all offer leveraged trading features in some capacity.

Coinbase

Coinbase is one of the most beginner-friendly platforms in the crypto space. While its standard platform doesn’t offer leverage, Coinbase Advanced Trade provides limited leverage trading options for eligible users. It’s a solid choice if you’re just starting out and want a secure, regulated platform. However, if high leverage is a priority, you’ll need to look elsewhere.

Kraken

Kraken is a well-established exchange that supports up to 5x leverage on spot trading and more on leverage trading. It’s a good middle ground between ease of use and advanced features, making it ideal for traders who want to explore leveraged trading without diving into overly complex derivatives markets.

Bitstamp

Bitstamp is one of the longest-running crypto exchanges, known for its strong regulatory compliance and reliability. While it doesn’t offer the highest leverage, it’s an excellent choice for those who prioritize security and fiat on/off ramps. The trading experience is simple, making it a good fit for beginners transitioning into more advanced strategies.

KuCoin

KuCoin is a favorite among traders who want access to higher leverage and a wide range of altcoins. The platform supports up to 100x leverage on margin trading, making it more suitable for traders looking for aggressive strategies. While it lacks the strict regulatory framework of platforms like Kraken or Coinbase, it offers a feature-rich experience with margin and derivatives trading.

HTX (formerly Huobi)

HTX offers one of the highest leverage options, with up to 200x leverage on contracts. While this level of leverage is risky for beginners, the platform also provides copy trading, which allows new traders to follow experienced professionals. If you’re looking for a wide range of trading tools with deep liquidity, HTX is worth considering.

Is crypto leverage trading allowed in the USA?

Yes, crypto leverage trading is allowed in the USA, as long as you trade on platforms that comply with US regulations. The key is to use an exchange that is properly registered and follows the legal framework set by regulatory bodies like the CFTC and SEC.

However, not all exchanges can offer leverage trading to US traders. Many international platforms, such as Binance, Bybit, and OKX, restrict US users due to regulatory compliance requirements. That said, there are still regulated platforms that legally offer this type of trading in the US, provided they meet the necessary licensing and compliance standards.

How crypto leverage trading is regulated in the US

Crypto derivatives, including margin and leverage trading, fall under CFTC oversight. This means any platform offering leveraged crypto trading to US customers must register as a Designated Contract Market (DCM) or a Swap Execution Facility (SEF). If a platform doesn’t meet these requirements, it can’t legally offer leverage trading in the US.

Additionally, SEC regulations limit access to high-risk leveraged products for retail investors. Many exchanges that operate freely in other countries do not offer leverage trading to US customers due to these restrictions.

Where can US traders legally trade?

Despite restrictions, some platforms operate legally in the US while still offering leveraged trading:

- BYDFi – Allows up to 200x leverage and is registered with FinCEN as a Money Service Business (MSB).

- BTCC – Offers up to 500x leverage and is licensed to operate in the US.

- Phemex – Provides 100x leverage and is registered as an MSB in the US.

These platforms comply with US regulations, making them some of the few legal options available to American traders.

Why do most platforms restrict US users

A key reason why many offshore exchanges block US traders is the heavy compliance burden. To operate legally, platforms must:

- Register with the CFTC for offering leverage trading.

- Implement KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements.

- Follow strict reporting guidelines on leveraged trading activity.

Most offshore platforms simply choose to avoid the US market instead of meeting these costly and complex regulatory demands.

Best exchanges to short crypto in the USA (short selling platforms)

If you’re looking to short-sell crypto in the USA, your options are limited due to strict regulations, but a few offshore platforms still allow it. We’ve listed exchanges below that let U.S. traders open short positions on Bitcoin and other cryptocurrencies using leverage.

These platforms support derivatives like perpetual contracts or leverage trading, making it possible to profit when the market goes down. Just keep in mind that shorting from the U.S. usually requires KYC-free or offshore accounts, as major U.S. exchanges don’t offer this functionality.

If you want to open short positions as a U.S. trader, here are three reliable platforms from our list that offer leverage trading with access from the United States:

- BYDFi – Offers up to 200x leverage with multiple contract types (USDT-M, COIN-M, inverse). No KYC required and registered with FinCEN in the U.S.

- BTCC – Provides ultra-high leverage up to 500x for major pairs like BTC/USDT. U.S. users can trade without KYC and access a demo account for testing.

- Phemex – Registered as an MSB in the U.S. and offers up to 100x leverage on perpetual contracts. Features a fast, pro-level trading app and supports both cross and isolated margin.

These platforms make it possible to profit from declining crypto prices, even as a trader located in the United States.

How to choose the best crypto leverage trading platform

The exchange of your choice should be selected carefully as it can greatly impact your trading experience.

Below are some key factors that will help you when choosing a platform.

- Reputation and security: Prioritize an exchange with a solid track record of keeping customer funds safe. Look for a platform that has previously not suffered from hacks or other breaches.

- Regulatory compliance: A regulated exchange will always be a better option because you know that it has gone through harder scrutiny and implementation of KYC processes to protect users. Regulators also require Anti-Money Laundering procedures to be in place to operate under such licenses.

- Leverage options: Ask yourself how much you are going to need from your crypto exchange. Not all traders should opt in for the maximum of 200x immediately. Instead, focus on the appropriate ratio for your needs.

- Trading fees: Leverage is surely going to increase your fees and I would say that choosing an exchange with the lowest fees possible is a great start. If you are an active scalper this will be your best way to save cash.

- Available assets and trading pairs: If you are looking for more trading pairs than just BTCUSDT it’s wise to take a look at the coin page and see just how many assets are listed on the exchange. Not all exchanges have the same assets and some prioritize newly listed coins.

- Liquidity: Liquidity and margin go hand-in-hand and your exchange must have deep order books. Higher liquidity reduces slippage, especially during turbulent market situations.

- User interface and trading tools: Asses the user interface and the available trading tools such as drawing tools, charts, indicators, order types, and risk management tools. Most technical traders need a steady chart and a fast matching engine to operate.

- Customer support: Carefully consider the quality of customer support. If you ever get in trouble with lost funds or for some reason lose your account login, a fast customer support agent will be your best friend.

- Educational resources: Choose an exchange that can help you along the way with guides, videos, and tutorials. These resources are valuable for both beginners and seasoned traders.

- User reviews: Take into consideration what feedback the crypto community is giving to each exchange. While your experience might be completely different from other traders it’s still worth taking a look online to see what they are saying.

How we tested and reviewed the platforms

Our list of top platforms for leveraged crypto trading was created by thoroughly testing reputable brands. To provide an objective review, we followed a comprehensive live testing process.

Here is an overview of the steps involved:

- Research and selection

- Account creation and KYC-verification

- Platform feature testing

- Trading experience overall

- Leverage test

- Security and Compliance

- Customer support

- Fees and costs

- User feedback and reputation

By following this rigorous testing process, we aimed to deliver an unbiased view of the platforms in our top lists. All platforms have been thoroughly tested by Anton, our leverage expert with over 10 years of experience in the trading field.

FAQ

Crypto exchanges offer between 100x up to 200x depending on the trading pair. Most Bitcoin trading pairs offer higher ratios due to lower volatility.

When using 10x on a crypto exchange it means that you are borrowing 10 times the money you have in your account. For example, if you have $500 in your account, adding 10x leverage would mean that you now control $5000.

Cryptocurrencies are a volatile asset and it’s not wise to overleverage due to the risks of large price swings. Therefore we recommend not using more than 1:10 or 1:50 if you are a beginner.

Many platforms mentioned here offer 100x leverage, while BYDFi and BTCC provide up to 200x.

To trade altcoins with leverage, sign up on BYDFi.

To engage in Ethereum leverage trading, sign up with BYDFi or Bybit.

Among the platforms that I have recommended in this article, StormGain and PrimeXBT give the highest leverage of 1:500 and 1:1000.

Conclusion

BYDFi stands out for its flawless interface, low fees, and great tools for active traders.

Some other platforms to consider are Bybit, Phemex, and Binance which all have great reputations both in reviews online and also from community forums.

Trading in the cryptocurrency market offers the potential for increased profits but it also comes with higher risk.

When choosing a crypto exchange, consider the factors outlined in this article.

By conducting thorough due diligence, you will be able to select the platform that matches your preferences.

This guide provides a strong foundation to help you choose a platform that aligns with your trading goals.

Please note that the information provided in this article is for informational purposes only and should not be considered financial or investment advice.

Crypto markets are highly volatile which increases the risk of loss.

Always do your research and consult with a professional financial advisor before making any investment decisions.