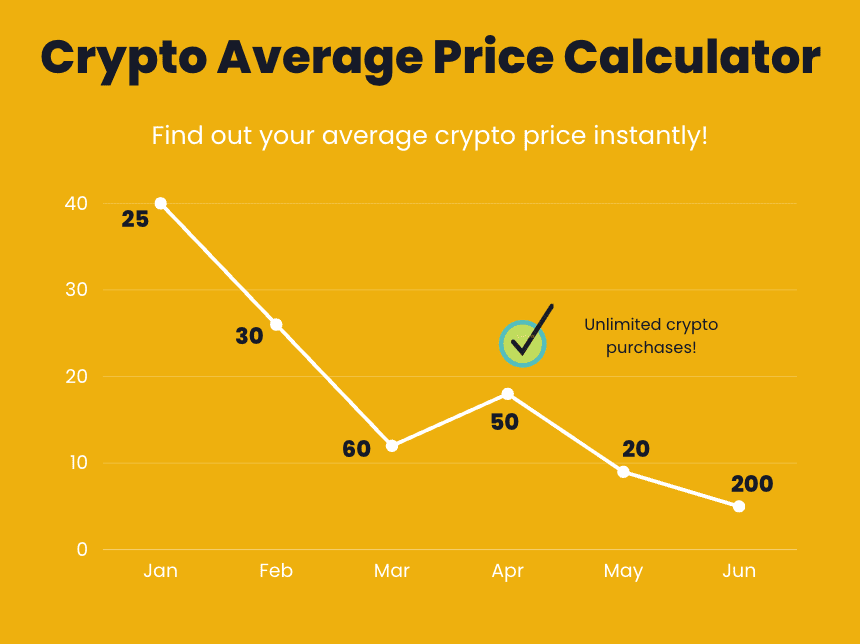

Use our crypto average price calculator to calculate the average price for your crypto investments made over time.

Crypto Average Price Calculator

Average Buy Price: $0.00

How to use the crypto average cost calculator:

- Add the amount of crypto bought. (e.g. 50, 120, or 2000)

- Add the crypto price for each purchase. (e.g. $0.03, $2.50, or $27500)

- Click the “Add More” button to add more crypto buys.

The average price calculator for crypto calculates the average cost automatically. When you remove a row, the calculator recalculates the average cost based on the remaining rows.

What is a crypto average price calculator?

A crypto average price calculator is a tool that helps investors and traders figure out the average purchase price for several crypto investments over time.

For example, if you have been buying Bitcoin during the past couple of months at different prices and in different quantities, it might be difficult to keep track of your true average price.

In this case, the calculator helps investors measure the average price for their investments which in turn helps them track the break-even price and gives them a clearer view of their investments.

Given the high volatility in the crypto markets, the purpose of the average cost crypto calculator is to help investors track their investments.

How does it work?

Just like our average down stock calculator calculates the average price for stock investments, this calculator calculates the average price for cryptocurrency investments.

Step 1.

A user starts by adding the inputs into the calculator, such as:

- The amount of crypto bought.

- The price at which the crypto was bought.

Step 2.

If a user has made several crypto investments at different prices, he can add each purchase by using the “Add More” button. This will ensure that each crypto purchase is included in the calculation.

Step 3.

When all the investments have been added, the calculator makes the calculation automatically by first processing the information and then giving the result. It sums up the full amount of crypto bought and takes into consideration at which price each investment has been made.

Step 4.

When the result is displayed, the investor can see the average price along with some added information such as the total amount of cryptos bought and the total amount invested in dollars.

How to calculate the crypto average price

Here is a step-by-step guide on how it is done:

Step 1.

Make a list of all the cryptocurrencies you have bought and at what price each specific crypto has been bought at.

Step 2.

For each purchase, calculate the total cost and the total amount:

- Multiply the amount of crypto bought by the price at which you bought it to find the total cost for that purchase.

- Sum up the total cost of all purchases to find the overall total cost.

- Sum up the total amount of crypto bought across all purchases to find the overall total amount.

Step 3.

Calculate the average price by dividing the total cost by the total amount of crypto, like this:

- Average Price = Total Cost / Total Amount of Crypto

Calculation formula

To calculate the crypto average cost, you can use this simple formula:

Average Cost = Total Cost of Crypto / Total Amount of Crypto

Here’s a step-by-step breakdown of the formula:

- Calculate the total cost of crypto:

- This is obtained by adding the cost of all individual purchases.

- For instance, total cost of crypto = (cost of purchase 1 + cost of purchase 2 + cost of purchase 3)

- Calculate the total amount of crypto:

- This is obtained by adding all the units of cryptocurrency purchased.

- For instance, total amount of crypto = (amount from purchase 1 + amount from purchase 2 + amount from purchase 3)

- Finally, divide the total cost of crypto by the total amount of crypto to find the average cost.

Why does it matter for traders?

Using the average crypto cost calculator is important for any investor that wants to keep track of the average price, also called, the break-even price.

The calculator helps you control your risk when investing in cryptocurrencies long-term by letting you know how much crypto you have bought, how much you have spent, and what your average price is.